By David Enna, Tipswatch.com

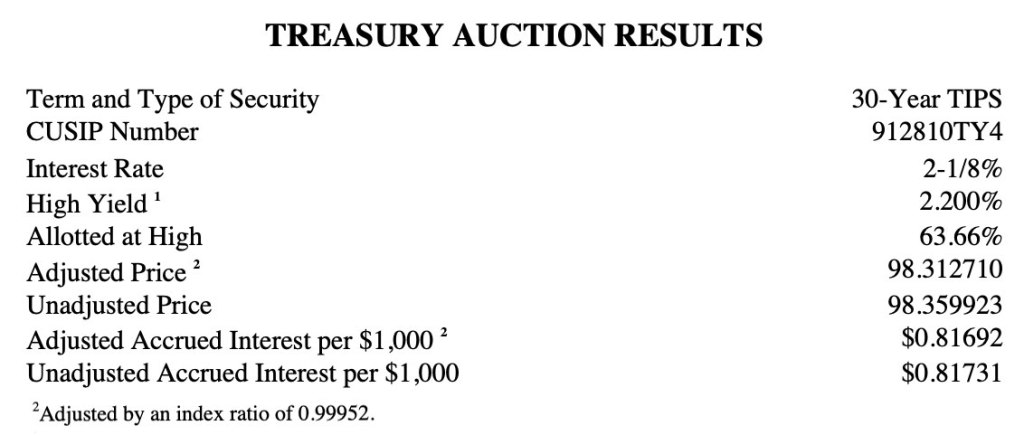

The Treasury’s auction of a new 30-year Treasury Inflation-Protected Security — CUSIP 912810TY4 — generated a real yield to maturity of 2.20%, the highest for this term at auction since February 2010. The coupon rate for this TIPS was set at 2.125%, matching a 14-year high.

I consider this a solid result. Just before the auction close, a similar TIPS was trading on the secondary market with a real yield of 2.19%, so the auction result was very close to market. The bid-to-cover ratio was a solid 2.48.

When looking at this result in historical terms, it is worth noting that the Treasury stopped issuing 30-year TIPS from October 2001 to February 2010. So today’s result matches the highest yield and coupon rate in the era since February 2010.

Pricing

Because the coupon rate was set slightly lower than the auctioned real yield to maturity, investors got this TIPS at a slight discount, with an unadjusted price of 98.359923. In addition, the TIPS will have an index ratio of 0.99952 on the settlement date of February 29. So this is how a $10,000 investment in this TIPS would be priced:

- Par value: $10,0000

- Adjusted principal ($10,000 x 0.99952) = $9995.20

- Cost of investment ($9,995.20 x 0.98359923) = $9,831.27

- + Accrued interest = $8.17

This is a pretty simple auction result to understand. The investor got $10,000 in par value, but paid $9,831.27 for $9,995.20 in principal as of Feb. 29. The accrued interest will be returned at the first coupon payment on August 15.

Inflation breakeven rate

With the nominal 30-year Treasury bond trading at 4.47% just before the auction result, this TIPS gets an inflation breakeven rate of 2.27%, which looks fine. This means the TIPS will outperform the nominal Treasury if inflation averages more than 2.27% over the next 30 years.

Here is a history of recent TIPS auctions of this term:

• Now is an ideal time to build a TIPS ladder

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

David, thanks for the variety of ways you help to explain the value of TIPS. I started to pick up some at auction and now this 30yr option. I didn’t understand the final purchase price calculation until your example above. I’m holding off on the I bond purchase until April as you recommended but have a request when you return from that awesome vacation: Can you show the combined payout of a historical 5- or 10-year TIPs at maturity where it has the same fixed rate (or very similar) as an I bond issued in the same period? I’m trying to see if an I bond redeemed after 5 or 10 years would have similar yields as 5- or 10-year TIPs from the same issue period with similar fixed rates. Thanks for all your help.

Potentially higher next Ibond fixed rate?

I will need to write about this soon. With the 5-year TIPS at 1.96% and the 10-year at 2.02% — and if those rates hold into late April — I think the I Bond fixed rate will hold at 1.3% at the next reset. That’s a guess, and a lot can change in the next two months.

Then it would be reasonable to wait until April before buying part, all or none of the 2024 I Bond allotment?

Thanks,

Yes, in mid April we will know the new variable rate and have a good idea of the new fixed rate.

While yield comparisons with prior 30year TIPS auctions are interesting, I think it is also worth noting yields on the secondary market. 30 year TIPS yields on the secondary market have been above 2% for most of the past 6 months and eclipsed 2.5% in October 2023, and haven’t been in this range since 2011.

This is true. The secondary market is constantly shifting and real yields still haven’t hit the daily highs of late October 2023. For a person building a TIPS ladder, this is the first and only offering maturing in 2054. The high coupon rate is also attractive, for investors who want a high coupon rate. (I do, but it is not a huge deal.)