- Blog

- 4 min read

Evolution of Startup CFO: 5 points to consider before building finance function

In order to understand the need for startups to hire a CFO who calls spade a spade, one must look beyond numbers. The author Amit Kulkarni, the Director Finance of an early stage venture fund, Fireside Ventures explores the imperatives of building a finance team in a startup and how founders should look at the function in the making.

Early-stage startups are now realising the significance of having a competent CFO on board, who can not only manage book-keeping and compliance, but also call a spade a spade, and raise the alarm when needed. Mature founders now understand that as their company grows, the role and the responsibility of their CFO does, too.

Evolution of a Startup CFO

Finance role grows with business

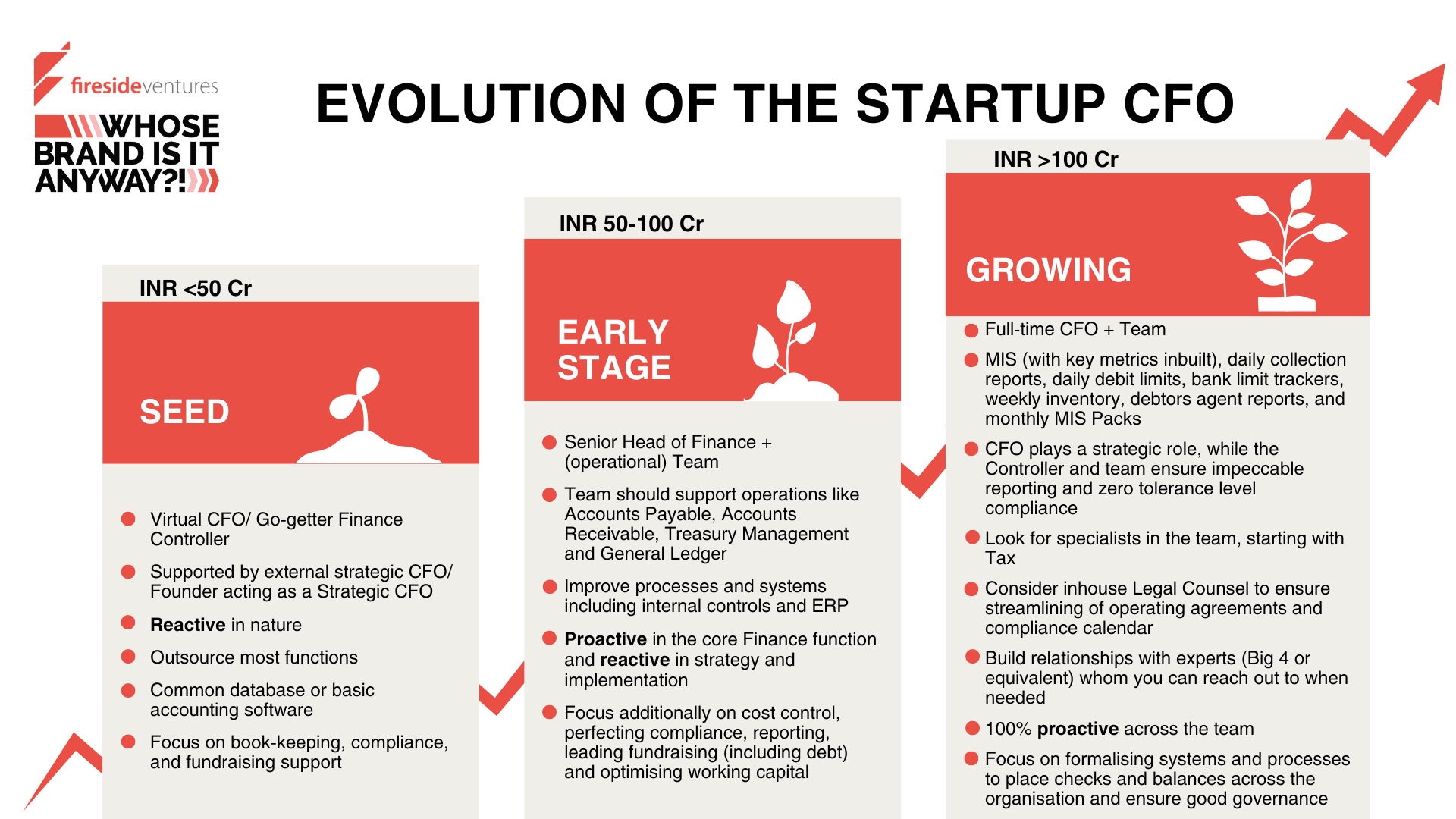

In the early stages of a startup, it’s common to hire generalists with a can-do attitude. But as you grow, you manage them and if need be, even replace them with specialists. This is particularly relevant for the finance team.

Series A or pre-Series A company can opt for a virtual CFO or a part-time CFO — someone with experience to get the nuts and bolts right, but as the company grows, the CFO's focus, more often than not, shifts. Initially, your CFO might be protecting the business through better contract negotiations, accurate and timely bookkeeping, and compliance.

Also Read: Affordable CFOs on Rise

But as the company prepares to raise funds from larger institutions, and starts to become an enterprise, their duties would include fundraising, working capital management, and being the torch bearer of not just good, but great governance practices.

Chief Financial Officer alias Chief Foresight Officer

In any organisation, finance is a truly centralised function. This makes it a very valuable position in a startup -- to draw business insights and use them to guide strategic decisions; advise the HR function on resource planning; budget planning; help operations understand the true cost, hidden costs, complex costs – of running the business. The finance function is therefore foundational: it can either free up or tie up the startup founder’s time and energy.

Perceptive founders are quick to realise that it is the only function that can hold a mirror up to all the company functions, regardless of geography, seniority or any other parameter, and accurately determine performance and integrity.~

As a function which is not vested with delivering growth and profitability on its own, the finance function is a critical link between strategy and operations, and this is by far the best position to anticipate developments in the near future, review and perceive risks independent of the business goals, and leverage this knowledge and mindspace to prepare the company to deliver its goals in this dynamic environment.

Better data, better decisions

A CFO brings data discipline to the business, and it’s helpful to invest in technology and processes that serve up reports in a form that you can use. One may not invest in a full-blown ERP right away, but appropriate automation at each stage will lead to uniformity in reporting, which in turn enables greater clarity in decision-making.

Systems and processes are also usually a struggle to fix later. Take, for instance, discrepancies between TDS and GST filings, or non-compliance with FDI regulations for a company’s business model. The CFO holds the reins on all matters related to bookkeeping and compliance, so that the data being presented to investors, other businesses, and the government is consistent.

1. In-house vs. outsourced

The rule of thumb is to outsource repeatable, expertise-driven functions, and keep judgement-based, business-critical functions in-house.

2. When to move everything in-house

At what point of your startup journey, will you choose to have Finance 100% in-house? One way to think about this is weighing the cost of hire versus the cost of outsourcing. When volume and answerability increase, in-house resources are typically more cost and quality efficient. But remember that you probably will still need external experts for issues like legal, tax, and regulatory, which are irregular and require a deep knowledge base.

3. Operations versus strategy

Start with basics – accounting, taxation, and diligence –before moving to strategy. Till that time, consider having a co-founder play the role of the strategic CFO. At scale, your CFO should be that independent sounding board which no one else can be, as they are delivering vertically.

4. No do-overs

Finance-related areas like compliance and reporting sometimes carry a high price-tag. This is an investment, and like all investments, it is best appreciated a little further down the road. It’s also an area that you have no chance to fix later. Think of this as how your VCs have thought about you and your company.

5. Trust

Don’t take on a CFO without being prepared to trust and support them entirely. The success of your startup depends on it. The end goal should be that this CFO should be a mirror, right up to the highest rungs of the organisation.

In my opinion, founders should always look beyond the numbers. Leverage the strategic, independent, and insight-led side of your CFO so you can work together to build a fundamentally sound, profit-oriented business together - a CFO who can help you align your 30,000-feet high vision with the on-ground business and regulatory realities.

Disclaimer: The views expressed are solely of the author and ETCFO.com does not necessarily subscribe to it. ETCFO.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions