Thinking of Selling? First, Understand Your EBITDA

Author: Larry Chester, President

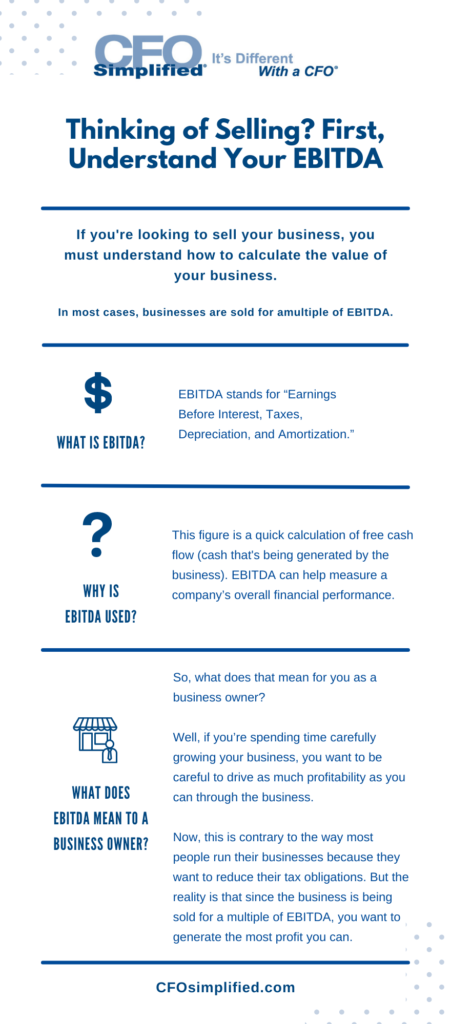

If you’re looking at selling your business, one of the things that’s important for you to understand is how you calculate the value of your business.

Here, we have Larry Chester, President of CFO Simplified, on camera to discuss why you should first understand your EBITDA prior to selling your business.

What is EBITDA?

In most cases, businesses are sold for a multiple of EBITDA, which stands for “earnings before interest, taxes, depreciation, and amortization.”

Why is EBITDA Used?

The reason this number is used is that it’s a quick calculation of free cash flow; in other words, cash that’s being generated by the business.

The exception is that interest and taxes are obviously cash expenses of the business, but because they change based on the owner’s individual tax situation, EBITDA creates a very standard way of calculating it.

In short, EBITDA can help “measure a company’s overall financial performance,” and in some cases, is used as an alternative to net income.

What Does EBITDA Mean to a Business Owner?

First, a lot of times we’re looking at multiples that may range from three times EBITDA to as much as 10 or 12 times EBITDA. This depends on how valuable the business is to the strategic or the financial buyer who is making the purchase.

So, what does that mean for you as a business owner?

Well, if you’re spending time carefully growing your business, you want to be careful to drive as much profitability as you can through the business.

Now, this is contrary to the way most people run their businesses because they want to reduce their tax obligations. However, the reality is that since the business is being sold for a multiple of EBITDA, a business owner wants to generate the most profit that they possibly can.

How Can You Generate the Highest Level of Profitability?

So, how do you generate the most profit that you possibly can?

One of the ways a business owner can support profitability is by paying personal expenses rather than running them through the business.

An Example of Profitability

Here’s an example.

Let’s say that on an annual basis as a business owner, you generate $100,000 of additional expenses that you’re putting through your business.

Perhaps you have a car, insurance expenses, travel expenses, or other things that as a business owner you arrange to put through the business to reduce its profitability.

Now, that’s $100,000 that you don’t have to pay taxes on, but the other side is that if you sell your business for an eight times multiple, that means that by pushing that other $100,000 of expenses through the business, you’re reducing the selling price of your business by $800,000.

Now, I doubt that you’re spending an additional $800,000 in taxes for that extra $100,000 that you’re earning … So, what do we recommend?

The Bottom Line

The reality is that by managing the expenses you put through your business—and by being careful about how you do that—you can generate more EBITDA and therefore, generate a higher multiple and a higher sales price for your business when you decide to sell it.

Interested in learning more? Read on for information on how a CFO can help sell your business.

Related Posts

7 Strategic Planning Steps to Make Your Company a Future Success

Are you missing Strategic Planning? Let’s quickly get through the first three items in any strategic plan. Here’s a quick

Cash Flow Solutions –

Twelve Things To Do If You’re Cash Short

Every business ends up short of cash from time to time. But there’s short of cash, and then there’s SHORT

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.