Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JUNE 18, 2025

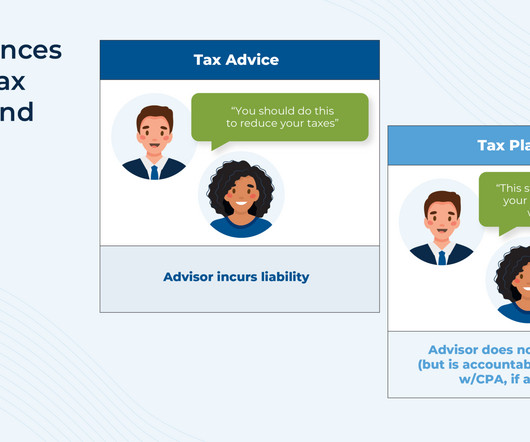

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as "tax planning", not "tax advice" – a distinction largely driven by liability concerns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Plans

OCTOBER 29, 2024

Embracing Technology for Financial Modernization Digital transformation is a game-changer in modernizing financial operations. These technological advancements facilitate seamless integration into client workflows, ensuring operational efficiency and better decision-making.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Plans

NOVEMBER 4, 2024

By employing advanced forecasting tools and real-time financial reporting, they maintained a healthy cash reserve, allowing them to invest in new markets and technologies confidently. Embracing Emerging Trends in Financial Planning As the financial services industry evolves, embracing emerging trends becomes imperative.

E78 Partners

MARCH 3, 2025

Strong public market valuations in key sectorsespecially technology and healthcareare attracting growth-driven businesses. Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations.

Global Finance

DECEMBER 6, 2024

Mid-Atlantic Midwest: Fifth Third Private Bank While having more than 160 years of local knowledge in the two key, highly industrialized US regions, Fifth Third Private Banks secret to staying at the top is an intricate mixture of innovative offerings, strategic technology use, and undisputed regional positioning.

Nerd's Eye View

MAY 29, 2025

investment strategies or tax planning) – can reduce cognitive overload for clients and keep meetings on track. Visual aids can also help advisors clarify complexity and reinforce key messages. Summary charts or graphics – especially for topics that come up repeatedly (e.g.,

Nerd's Eye View

OCTOBER 28, 2024

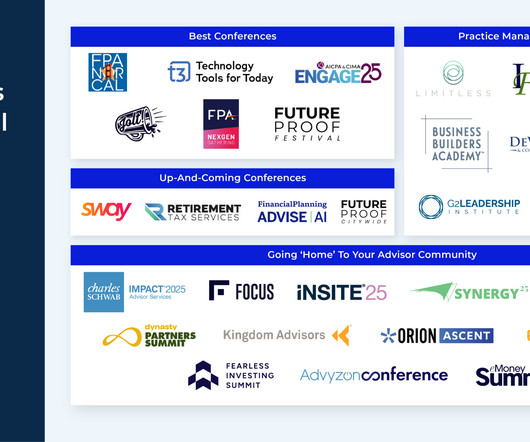

to conferences on marketing, learning business development skills, or developing next generation talent, to the top events for those who still use conferences to up their technical game in areas like tax planning.

CFO Plans

JANUARY 20, 2025

This guide aims to equip you with essential tools and insights to simplify tax filing, ensuring you’re not only compliant but also maximizing potential savings. Strategic Tax Planning for Entrepreneurs The foundation of effective tax management begins with strategic planning.

Global Finance

OCTOBER 31, 2024

China’s largest bank works directly with EV manufacturers such as Guangzhou Xiaopeng Motors Technology, Zeekr, and Li Auto to provide one-stop loan application, facility, interview, and issuing services. CCB’s Guangdong Province branch in March reported lending ¥160 billion to more than 50,000 local, technology-based enterprises.

CFO Dive

JUNE 23, 2025

That environment can easily lead to paralysis, with business leaders waiting for more information before undertaking planning actions. However, proactive planning can be a crucial tool that helps businesses to find stability within a challenging environment. What can a business do to plan for continually shifting tax rules?

Nerd's Eye View

APRIL 7, 2025

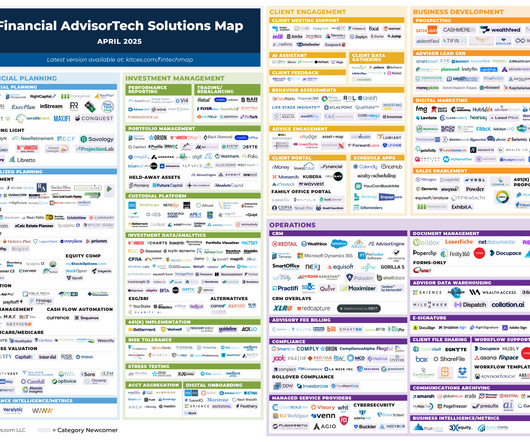

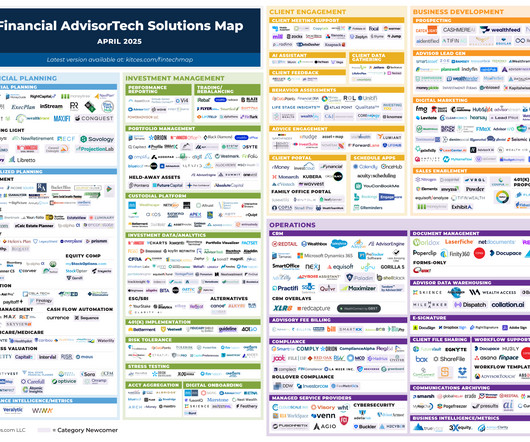

Welcome to the April 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

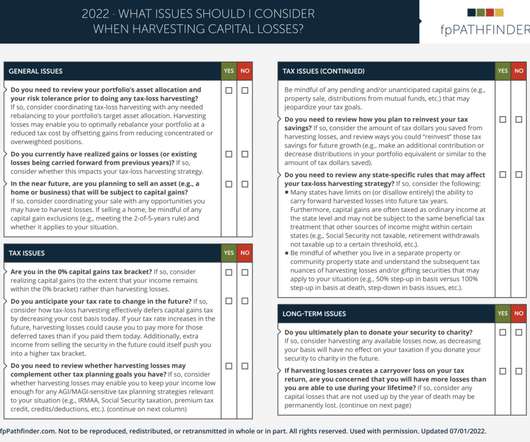

OCTOBER 5, 2022

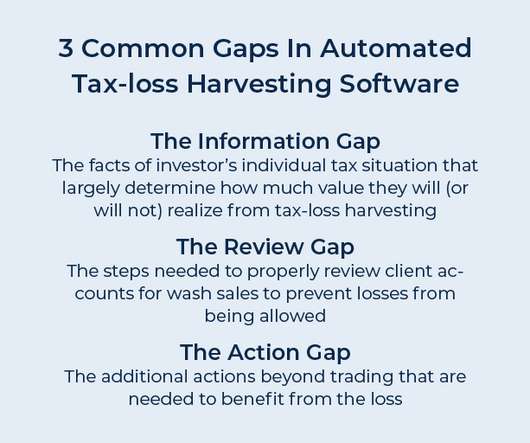

Unfortunately, much of the technology dedicated to automated tax-loss harvesting fails to consider the individual tax circumstances that drive most of the true value of harvesting losses, and instead focuses on the portfolio-management aspect of efficiently capturing as many losses as possible.

CFO Plans

AUGUST 2, 2024

In today’s rapidly evolving business landscape, the integration of technology into accounting practices has shifted from a luxury to a necessity. With the demands of modern businesses continuously growing, leveraging technology to streamline accounting processes is crucial for maintaining accuracy, efficiency, and competitiveness.

Nerd's Eye View

JANUARY 8, 2024

Professional service industries tend to evolve over time as the regulatory environment evolves and new technologies emerge. For instance, the financial advice industry has seen many changes to regulations (for both advisors and their clients), advisor business models, and the advisor technology landscape.

PYMNTS

OCTOBER 19, 2020

Here’s the latest news from Amazon and the technology industry, which is coming under increasing scrutiny from regulatory watchdogs, trade organizations and politicians globally. The OECD forecasted that the measures could bring in a further $100 billion in business tax revenues each year. . Regulation.

Nerd's Eye View

OCTOBER 2, 2023

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

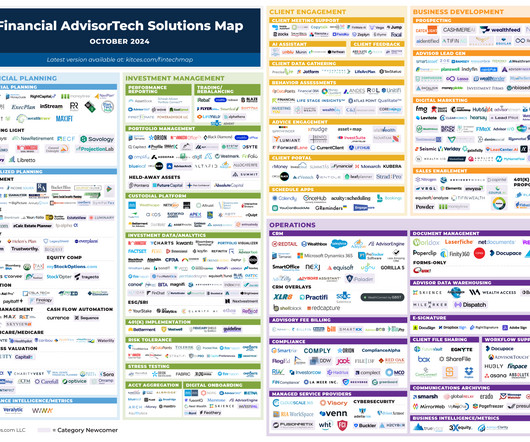

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

SEPTEMBER 7, 2022

For example, advisors who use a Customer Relationship Management (CRM) tool may be able to use that tool to narrow down the list of clients to those who are good tax-loss-harvesting candidates, such as those in higher tax brackets (who are likelier to realize more value from deducting capital losses). With these three tools (i.e.,

Nerd's Eye View

FEBRUARY 19, 2024

The 2024 Technology Tools for Today (T3) Advisor Conference, held last month in Las Vegas, Nevada, featured a large gathering of financial advisors and representatives from across the fintech industry. A continual thread through the conference was the ongoing effort to build a truly cohesive tech stack.

CFO Plans

AUGUST 23, 2024

Strategic Financial Planning and Tax Savings Tax Planning and Preparation Effective tax planning and preparation can significantly impact your business’s bottom line. A Fractional CFO leverages their in-depth knowledge of tax laws to ensure compliance and identify opportunities for tax savings.

Nerd's Eye View

APRIL 7, 2025

Welcome to the April 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

JULY 12, 2022

In this episode, we talk in-depth about how, after years of working in an environment where she saw first-hand how ultra-high-net-worth clients keep and grow their wealth (and the lack of diversity among those clients), Kamila decided to build a practice that focused on providing holistic financial planning to communities of color with emerging wealth, (..)

PYMNTS

OCTOBER 5, 2020

Here’s the latest news from Google and the technology industry, which is coming under increasing scrutiny from regulatory watchdogs, trade organizations and politicians globally. Brussels also aims to have big platforms allow users to remove programs that come already installed on technologies like computers and smartphones.

CFO Plans

JUNE 27, 2024

Expert Tax Planning and Preparation for Savings Navigating the complexities of tax regulations can be daunting for any business. Certified public accountants (CPAs) within outsourced accounting firms offer expert tax planning and preparation services. Get expert tax planning and maximize your savings.

CFO News Room

DECEMBER 30, 2022

A new study shows that there is a wide gap between firms leveraging technology to enhance the client experience and those that do not treat their tech stack as a priority. Why advisors might consider looking past some of the big names in advisor technology to find tools that can provide a better experience for themselves and their clients.

CFO Plans

JUNE 13, 2024

Enhance Your Financial Reporting with Expert CFO Services Effective Tax Planning and Preparation Tax planning and preparation can significantly impact a company’s bottom line. Fractional CFOs offer expert guidance on tax strategies, ensuring compliance and optimizing tax liabilities.

CFO Plans

JUNE 7, 2024

Enhance Your Financial Reporting with Expert CFO Services Effective Tax Planning and Preparation Tax planning and preparation can significantly impact a company’s bottom line. Fractional CFOs offer expert guidance on tax strategies, ensuring compliance and optimizing tax liabilities.

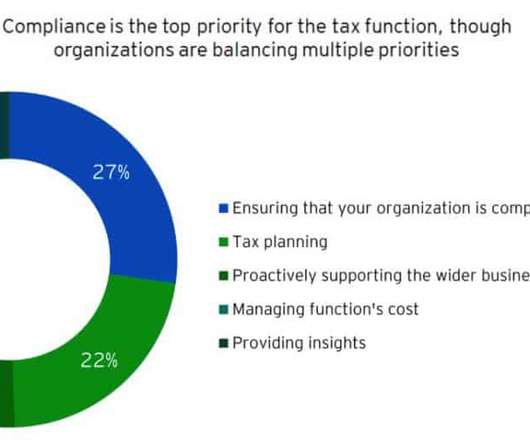

Future CFO

JANUARY 15, 2024

Fear of double taxation emerges among businesses amid global tax reform, said EY recently. Global tax reform, ineffective use of technology and economic uncertainty are putting significant strain on business’ transfer pricing (TP) capabilities, according to the 2024 EY International Tax and Transfer Pricing Survey.

PYMNTS

DECEMBER 1, 2020

France has long been angling to levy digital taxes, although such moves have become a bone of contention with the United States and have faced significant delays. Treasury argued last year that one such French tax plan was discriminatory and unfairly targeted U.S. billion of French goods.

Future CFO

OCTOBER 4, 2021

There are many highlights instead of one or two along the way—be it doing the advisory work for the then largest merger in Malaysia, or a successful tax planning endeavour that bore fruit, or perhaps now, hopefully, be part of the team that saved the largest low-cost airline in ASEAN.

CFO Talks

AUGUST 21, 2024

Economic shifts, new regulations, and technological changes constantly test your ability to keep your company financially stable. Strategic Measure: CFOs should build strong relationships with local tax authorities and regulatory bodies.

PYMNTS

DECEMBER 4, 2018

This tax is a replacement for the original plan that would have targeted around 180 of the largest technology groups by capturing activities such as data sales, raising an estimated €5 billion ($5.69 However, officials noted that other retailers like Amazon , Airbnb and Spotify would most likely be excluded.

CFO Plans

SEPTEMBER 24, 2024

These services offer personalized guidance on a range of financial issues, from tax planning to investment strategies. Affordable virtual CFO services leverage advanced technologies to deliver real-time financial reporting, empowering small businesses to stay agile and responsive in a competitive market.

CFO Plans

AUGUST 30, 2024

Leveraging technology to streamline accounting processes is no longer a luxury but a necessity. Tech-Enabled Accounting Tools Revolutionizing Real Estate Modern technology offers a plethora of solutions to address these challenges, making real estate accounting more efficient and less prone to errors.

Future CFO

MAY 24, 2020

Source: How a reimagined tax and finance function can improve your bottom line, EY 2020. The TFO team typically consist of dedicated accounting and tax professionals working in tandem to support the CFOs holistically.

CFO News Room

NOVEMBER 29, 2022

And so, I brought him in to help me redefine and reevaluate, one, our technology stack and also our overall client experience. So, we currently have our process, our systems, and our technology stack that we use but we can always be better. Anh: Yes, basically, that’s his main role. Anh: It was definitely the user interface.

CFO Plans

AUGUST 16, 2024

An outsourced CFO can offer strategic insights, from tax planning to financial forecasting, without the overhead costs of a full-time executive. Explore Outsourced CFO Options Embracing Technology with Virtual CFO Solutions In today’s digital age, virtual CFO solutions are becoming increasingly popular.

CFO Plans

MAY 30, 2024

Expert accounting consultants can also assist with tax planning and compliance, ensuring your real estate investments remain profitable. Outsourcing the setup and management of cloud-based accounting software ensures seamless integration and ongoing support, allowing your business to leverage the full benefits of this technology.

CFO Plans

SEPTEMBER 24, 2024

Leverage Technology: Utilize Remote Accounting Solutions and Virtual Financial Controller Services to streamline the forecasting process. Conclusion Financial forecasting is a powerful tool that provides small businesses with a clear vision of the future and enables strategic planning.

Creative CFP

JANUARY 17, 2019

Careful planning is essential. Customers are not paying on time In this day and age with fantastic cloud-based accounting technology, cash flow management is an easy problem to solve. The sooner you make peace with having to pay tax and make proper provision for it, the sooner you will start to enjoy running your business.

CFO Plans

OCTOBER 15, 2024

Leverage technology by utilizing software solutions designed for corporate governance compliance to streamline processes. Engage experts through CFO Plans to gain insights into the nuances of financial reporting standards for businesses. Practical Steps for Ensuring Compliance in Small Businesses 1.

CFO News Room

NOVEMBER 22, 2022

A lot of 401(k) plans at hospitals are with Fidelity. All the technology we had researched, some of it like Fidelity owns eMoney Redtail, all these CRM, everything just started to match. So, you go to an RIA, you obviously have lots of overhead of technology decisions, and you got to hire more team. We use Orion as a technology.

Future CFO

SEPTEMBER 14, 2020

Tam noted that FP&A professionals will then need to “revisit their financing and liquidity strategies, centralize decisions for cash release upon the applications of government stimulus, and implement tax planning strategies that can reduce cash expenditures and preserve budget.”. Empowering the new FP&A professional.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content