Episode 217

Recent Volatility and Crosswinds: Treasury’s Response

Host:

Craig Jeffery, Strategic Treasurer

Speaker:

Holly Olson, AFL

Episode Transcription - Episode #217 - Recent Volatility and Crosswinds: Treasury’s Response

Announcer 00:04

Welcome to the Treasury Update Podcast presented by Strategic Treasurer. Your source for interesting treasury news, analysis, and insights in your car, at the gym, or wherever you decide to tune it.

Craig Jeffery 00:17

Welcome to the Treasury Update Podcast. This is Craig Jeffrey, I’m your host for today’s session. It’s titled Recent Volatility and Crosswinds: Treasury’s Response, and I’m joined with Holly Olson, who’s a corporate treasurer at AFL. Holly, welcome to the Treasury Update Podcast again.

Holly Olson 00:35

Thank you.

Craig Jeffery 00:36

It’s good to have you on again. You’ve been on at least once I know we’ve presented at some different webinars. So I’m very glad to have you here. Before we get into some of the volatility that’s impacting every country, every company, maybe give us a quick thumbnail sketch of your your career and where your current responsibilities are.

Holly Olson 00:58

So let me give you that 30,000 foot overview of my career. I’m in Treasury now I have actually been in the treasury role for the past 12 years. I then prior to that I was an accountant in various organizations, and I kind of crossed over to the dark side, if you will. I’m now with AFL. AFL is a fiber optic manufacturer here in Duncan, South Carolina. For them, I am the corporate treasurer, responsible for all different kinds of things, Treasury, cash management, working capital, insurance, hedging, FX, and various things of that nature. So that that would be the 30,000 foot level.

Craig Jeffery 01:48

That’s awesome. I know, there’s a lot more you’re formally trained in accounting, CPA, well over a decade in Treasury. So yeah, excellent. Holly, you know, as we look at what’s going on in the world, from macroeconomic changes to fiscal policy adjustments, you know, across across the board, there’s a lot of changes happening, there’s volatility, there’s shifts, maybe there’s growth in certain areas, maybe you could describe what you see happening in this era of volatility, both both broadly, but also how it it’s impacting, you know, your role at your company.

Holly Olson 02:26

As you know, we’re all coming off of the COVID turbulence and thought we were getting back to normal when, you know, we had the Russian Ukrainian war, and that seemed to throw everybody into a tailspin, it also really changed the landscape. You know, prior to that we had supply chain issues, and we were all dealing with not having our raw materials or not being able to get them or it’s taken considerably longer than, than usual, to a point where that’s now starting to pre up. But now we’re faced with inflation. So inflation seems to be here amongst us all the way around the world. Most of it is driven by energy, as that is the key problem that’s occurring between Russia and Europe and now Europe’s having to find other sources of energy and, you know, that drives prices up and everything, everything we touch our to, from our food to our shipping, our prey, any kind of resource, any kind of material is going to be touched by energy in one shape or another. So it costs are definitely rising. And that rising costs then from a treasury perspective, leads to other challenges, working capital challenges, because now it’s costing you more to buy your materials and you may not necessarily be increasing prices to your customer straightaway. It also is impacting your foreign currency, because the inflation is depreciating, other currencies and depending on whether that’s a sale or cost could be good or bad for you. In most cases, a depreciating currency on your cost is really good if you have a lot of USD sales. But that could also be bad if you’re a multinational corporation, where you have foreign currency sales that you’re converting into USD. So that could be problematic. From that perspective. That’s most of what I see. But that’s what I got right now.

Craig Jeffery 04:41

Yeah, there’s there’s certainly a lot that you listed and I think we all know there’s there’s other things that are coming up fiscal and monetary policy adjustments, not only inflation, but interest rates that are being changed by the central banks and on and on that, that are the backdrop here, you know, in terms of your organization and maybe different divisions, if you will. Where are you in the growth cycle?

Holly Olson 05:04

That’s a very interesting question, Craig, because most companies are probably slowing down. At least from a monetary standpoint, Jay Powell is trying to slow the economy down. And that in turn will slow down a lot of companies and growth within those companies. However, with AFL, we’re in a totally different space. Because we manufacture fiber optic cable, it is in a supercycle, which is a continued growth period. And a lot of this has been driven by the pandemic, we all needed to have internet access. In some cases, it was difficult to connect on Zoom meetings, because there wasn’t enough bandwidth. It also was difficult for schools because world schools did not have necessarily internet connection, or their students did not all have internet connection. So they couldn’t necessarily continue teaching in a virtual world. And that put a huge spotlight on our infrastructure associated with connectivity. And that’s what we do we connect. So naturally, that has spurred a huge amount of growth, and so much growth, we just, we just can’t keep up with it.

Craig Jeffery 06:33

When you’re dealing with growth from the treasurer’s perspective, supporting the organization with capital with banking structures, and sharing payment processes are secure across the board. What are some of the growing pains that that are just natural that you’re you see emerge? You know, very slow growth is easy to handle. Faster growth and hyper growth are different situations. What are you seeing? And how are you responding to that?

Holly Olson 06:58

A company that is growing is is actually funding that growth before the cash comes in. And that puts stresses on the working capital, no doubt about it. You’re have we’re, we’re expanding lines, for example, we’re having to outlay money for capital expenditures, we’re having to buy material in advance out these lines getting up and ready. And that money is out of circulation for a period of time. And so it really plays havoc with the cash conversion cycle, if you’re used to in manufacturing, typically 90 days, but if you’re if you’re building that 90 days is going to be extended a little bit because of these other activities that are occurring. The other thing is the byproduct of of COVID where we went basically from a just in time inventory model to a just in case inventory model and and what do I mean by that what I mean is just in case we don’t receive it, we have it on hand. And that’s that that takes cash out of the picture as well and that plays havoc with the cash conversion cycle, extending it I heard one person tell me it was just insanity because the impact to the working capital is rather significant once you start slowing your inventory turns. And what do you have to do? You have to start really sharpening your pencil, looking at your credit facilities trying to determine, do you have enough credit facilities to withstand some of the the disbursements that are coming before the receipts come in. That’s basically been the huge challenge we’ve been facing.

Craig Jeffery 07:14

You think back when just in time inventory became so popular was the be all and end all of working capital management, things were things were smooth supply chains were smooth everything was there was barely a ripple on the ocean. It was like a smooth as a pond. And now we have like you said there’s there’s wars, supply chain impacts from shutdowns in China for COVID, to the war to you know, other types of constraints. And to adjust for the risk, it’s just in case I haven’t, having a margin having a comfort is necessary, but that that takes capital that’s a that’s a really, really good example, Holly. What is the response to these type of issues of volatility, crosswinds, crosscurrents, however you want to describe that, from a perhaps a company and a department level? What else are you doing to address no longer smooth pond to let’s say, a very choppy sea with crosscurrents?

Holly Olson 10:00

Yeah, so another problem with growing too fast is we are actually growing faster than our systems can keep up with. And that is really a huge problem. Our systems were designed when we were a much smaller company. And we could not have imagined that we would be where we are today 10 years ago. And so, once you have all that infrastructure in place, it’s the best way I can describe it is like an aircraft carrier, it takes a lot to move that and, and the challenges of becoming more agile and nimble is is very difficult when you had this burden of the infrastructure. And just a prime example is we had and this is more on the accounting side. But it also impacts our risk management side is we used to have one building have one business unit inside of it. Now we have multiple business units operating inside of it, we have a difficult time understanding what is being produced in building A versus building B, the efficiencies, the operational side of it, and then that falls over into the risk management side in what if Building B were to be hit by a tornado and was destroyed? How then do we determine what our claim levels are? And that is a huge challenge of growing fast, is not being able to keep pace with the decisions on the operational side of the business, and then being able to meet those needs. So Craig, that’s from a system standpoint. But from a people standpoint, the question becomes, do we have the right people in place, and like many companies across the nation, we were impacted by the great resignation, and our finance department was decimated. And you could look at this as a bad thing. Or a good thing. It’s bad that now those that are left behind, have more work, and are working more hours to compensate for the reduced staff levels. Or you can look at this silver lining here, which is okay, we’re a growing company, we need to really start looking at the skill sets that we need for the future and start really focusing in on what do we really need now. And in many cases, the individuals that left were hired when when we were small. And I’m not saying they were not good people or that they were not qualified. But the roles have changed. And the skill sets needed for those roles were changing. Now we have an opportunity really to revisit all of that and fill the roles with employees that are going to help us move forward into the future.

Craig Jeffery 13:25

Changing demographic, you know, Gen Z is entering the workforce moving into supervisory roles, that’s changing the whole COVID situation of people working from home. And sometimes that was great for working for some people and really bad for others. Do you look at this, a company that grows and changes your right to someone who might need to be able to wear 12 hats for 20 minutes a day. Now there’s more special specialization, some areas have to go really deep. You look at the staffing, I guess, across finance overall, not just treasury. How are you getting staff, the right kind of staff developing the bench for continuity planning, succession planning? What’s changing, especially as we think about the big thing used to be what’s the career path? And when things change dramatically in a couple of years, whatever the previous career path is, that may no longer be the case, because there’s 12 new roles and things have shifted and divided. What’s your thinking on that?

Holly Olson 14:28

So Craig, that is a mouthful. And so let me try to unpack that as best as I can. There’s a lot of a lot of things that you just mentioned. And so let me start on what we’re doing as as a finance team, and then kind of maybe drill down into the treasury department because I really see them as one in the same but the Treasury has unique unique situation with us only having two individuals in our department. But from the finance department, our team started to look at what were the reasons why our employees were leaving the company and trying to understand is this really just someone unhappy? Is there a common thread to this unhappiness? Is there money involved? Are they getting more money somewhere else? What is really driving some of the reasons, and probably the biggest reason that came out of this was employee development. You know, when you’re a small company, you don’t want to have a lot of room to grow. But as you grow, you do have opportunities. And how does Holly Olson move from, you know, corporate treasurer? Or maybe to another role? Maybe that I’m interested in? How do I do that? And so we started really reflecting upon ourselves. Well, yeah, we’re, we don’t really groom our employees, we really don’t sit and look at their career paths, we hire them for a role, and then we expect them to do that role. And to be honest with you, Craig, a lot of companies do that, especially when you’re not a large company, just for the fact that you don’t have a lot of areas in which a finance person can move. But our department, it’s not huge, but it’s it’s not small, either. We have maybe about 25, 30 people in the department. So there’s plenty of opportunities to move into different roles, we started really taking a look at the finance team, and building out a framework, employee development and in career paths. But when I say career paths, that has to be said, loosely, mostly because we’re growing, then these roles are going to change. So the role of corporate treasurer today is not going to be the same role as corporate treasurer tomorrow. And the skill sets I need today may be very different than the skill sets that I need tomorrow. And it’s really sitting down in with each of our employees and understanding, what is it that you’re looking for? Where do you want to go in the company? And then we need to start developing the employee, what are their skill sets? What skill sets are they lacking, and it’s really building this framework, as I mentioned, where you’re going back and forth, it has to be a dynamic process, it cannot be one and done. I sit down with you today and I say, Craig, I want to be in this role, three years from now. And then we map that that path out. And that it, it happens exactly that way. Because as you know, in three years time, when I get there, that role is either non existent, it’s totally different, it needs different skill sets, and I’m not ready to take it on. So it’s really having dialogue with the employees continuously engaging them, and continuously developing them and providing ways in which they can be developed. And lucky, luckily enough for AFL we do have a great training team, and they have a lot of material for our associates to take advantage of.

Craig Jeffery 18:36

You’ve got the human talent development and career pathing. In this time of volatility cross winds with a company that’s growing, I’ll just throw out a few things to like, maybe this is another unpack situation. It’s like, you’re in a supercycle, when there’s a lot of growth, there’s a lot of demand for resources throughout the organization for technology resources, staff resources, time, attention, and money. It’s not unlimited, no matter how fast you’re growing. And at the same time, how do you take on more from a system perspective, from an organizational perspective? It’s really an adaptation play. But how, how do you approach that?

Holly Olson 19:15

This is all part of our finance transformation that we began earlier this year. There’s actually three pillars in there. And one of the pillars was the the employee development that we just talked about. But another pillar is really transforming our finance department. And there’s really two pillars to that. And the one pillar is really setting up appropriate KPIs and starting to look at our processes and making them more efficient. How many manual processes are we doing? Can we improve that from a treasury standpoint? How many checks are we printing versus how many electronic payments do we have? And that is really a challenge that we have posed to all of our finance associates. Treasury included. And then the other pillar is really looking at the bigger picture. What is holding us back from being a nimble organization? And what do we need to do to transform ourselves to be agile, nimble, and more responsive in this day of real time data?

Craig Jeffery 20:42

I liked your comment about the real time data and the speed that has to move. I mean, that’s obviously gonna go over fiber optic lines, but the sheer growth of data and data that you can use, whether its exhaust data, system data, market data is tremendous. I was going to ask you a question at the end about what are your final thoughts on adapting for resilience? I wanted to maybe hear your final thoughts for adapting particularly in terms of monitoring, volatility and the cross winds that exist, so I mean take it however you want. But yeah, I’d just be curious, what are your final thoughts that you want to leave with the audience?

Holly Olson 21:19

If you want to go somewhere, you typically pull out your GPS, and you slap it into that GPS, and it may take you around the block a time or two, but you’ll eventually get to where you want to go. If you don’t put it in there, you’re going to get somewhere, but it may not be where you want to go. I feel like you’re always have to be looking into the future. You always have to be planning, you have to think ahead. Where can things go wrong in the future? Where are your potential pitfalls? As well as looking where you are today. You know, here’s where I am today. But I need to be here tomorrow. How do I get there? And I think if you don’t start planning and thinking ahead, you will never get there. And then tomorrow is going to come and you’re just not going to be prepared. So you have to always continuously be thinking of tomorrow, and adapting. And today I need to adapt. And then tomorrow, I need to adapt in the day after I need to adapt. And you always have to have that mindset. If you don’t have it. And you’re sort of stuck in a rut, you’re never going to change but everything around you is going to change. And that’s going to be fine for a while until one day you wake up and it’s not fine anymore. And now you’re in a fire mode trying to put out the fire trying to to resolve it without having enough time to put a solution in place.

Craig Jeffery 22:54

That’s excellent. Holly, I want to thank you so much for your your time and your thoughts on this episode of the Treasury Update Podcast.

Announcer 23:04

You’ve reached the end of another episode of the Treasury Update Podcast. Be sure to follow Strategic Treasurer on LinkedIn. Just search for Strategic Treasurer. This podcast is provided for informational purposes only, and statements made by Strategic Treasure LLC on this podcast are not intended as legal, business, consulting, or tax advice. For more information, visit and bookmark StrategicTreasurer.com.

Subscribe to the Treasury Update Podcast on your favorite app!

Related Resources

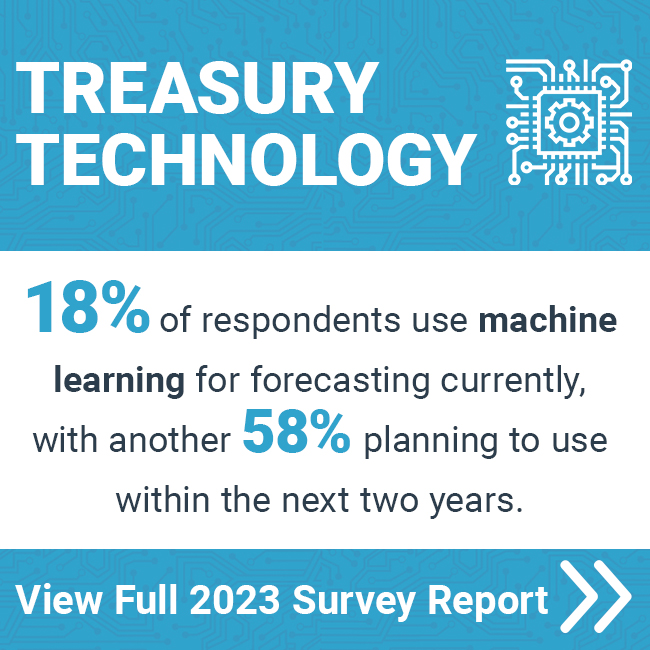

Treasury Technology Analyst Report

Researching new treasury and finance technology can be overwhelming. Strategic Treasurer has stepped in to help. Explore our definitive guide to the treasury technology landscape and discover detailed, data-based coverage of treasury technologies.

On this episode of the Treasury Update Podcast, Host Craig Jeffery sits down with Holly Olson, Corporate Treasurer at AFL, to discuss strategies for managing treasury. Topics of discussion center around treasury operations with a view to automated payments, risk management, support of global business units, fraud prevention and more. Listen in to learn effective strategies for optimizing treasury operations around the world.