What should I include in SaaS cost of goods sold (COGS)? This is a very common question from SaaS founders and finance teams. It’s also an important question and something that you need to get right.

The proper coding of SaaS COGS versus operating expenses (OpEx) is important for many reasons. First, we must understand our true, overall SaaS gross margin. Second, we must understand our gross margins by revenue stream. Third, without correct expense coding between COGS and OpEx, we cannot create the proper SaaS P&L. Finally, without a correct SaaS P&L, we cannot easily or accurately calculate SaaS metrics.

In this post, I’ll explain how to structure your cost of goods sold for SaaS, what’s included in COGS, and benchmarks for SaaS gross margins.

Bonus! Join me on October 13 at 10:30am MT for a free, live class on COGS vs OpEx! Register here.

What Expenses are Included in SaaS COGS

For pure play SaaS, your COGS structure should include technical support, professional services, customer success, and dev ops.

However, with the ever-changing pricing and business models of SaaS, your COGS may also include hardware and transactions. Transaction revenue may include usage, consumption, etc.

When I post expenses to a department such as technical support, the cost center should be fully burdened. Fully burdened means all expenses that arise from that department should be coded back to that department. For example, wages, taxes, benefits, travel, training, internal use software (ticket tracking, for example), pizza parties, and so on.

The department leader must manage and be accountable for all expenses under their control. Therefore, it’s important to be diligent on the monthly coding of expenses. I review all expenses by department with each close cycle to catch errant entries. Don’t let G&A be a dumping ground for department-specific expenses.

Next, I’ll cover the common expenses associated with each of these COGS departments.

Technical Support

The technical support department manages all inbound customer messages, emails, and calls regarding your product and/or services questions. These questions could be “how-to” or reporting bugs in your software. If you are early stage where employees wear many hats, they may also handle customer onboarding.

- WHAT THEY DO: inbound phone, chat, and web support for customer requests, issues, and bugs.

- TYPICAL EXPENSES: wages, payroll taxes, benefits, travel, training, internal software subscriptions (i.e., Zendesk), etc.

- MARGIN: the support department is included in your recurring gross margin.

- JOB TITLES: include support manager, technical support specialist handling level 1, 2, and 3 support.

- WHAT TO LOOK FOR: just tech support or also onboarding? Sizing of the department based on call volume/other stats? Remote or HQ?

- BOTTOM LINE: the support department is primarily employee-related expenses.

Professional Services

Service departments are critical to the initial success of your customer. If your software requires any configuration, implementation, and training, then you most likely have a services department.

However, not every SaaS company has a services department. If you have a lower price point, self-service product, you might not have a services team. If you sell into mid-market and enterprise customers, you are likely very familiar with the services concept (often called PS or Pro Serv).

Key metrics for a PS team include billable utilization and backlog. Backlog is contracted services revenue that has not been delivered and invoiced.

- WHAT THEY DO: implement and configure software and train customer on its use.

- TYPICAL EXPENSES: wages, payroll taxes, benefits, billable travel, travel, training, internal software subscriptions, PSA software, etc.

- MARGIN: services is included in your services gross margin.

- JOB TITLES: include field services manager, project managers, trainers, and implementation consultants.

- WHAT TO LOOK FOR: do they bill back travel? Are they hourly or fixed? Billable utilization? Backlog?

- BOTTOM LINE: typically, employee-related expenses and travel.

Customer Success

The customer success team is tasked with customer retention. They do not sell or hold a quota if we include our customer success team in COGS. This team is typically compensated on gross dollar retention or even net dollar retention.

The coding of the CSM team is another common question. If they sell and receive compensation for ARR/MRR expansion, then I would code them to OpEx as part of the sales team. They should be part of your expansion CAC.

- WHAT THEY DO: number one job is to retain customers and identify potential customer expansion.

- TYPICAL EXPENSES: wages, payroll taxes, benefits, customer travel, training, internal use software (i.e. GainSight), regional user groups, promotional swag, etc.

- MARGIN: CS is included in your recurring gross margin.

- JOB TITLES: include directors, managers, and customer success manager.

- WHAT TO LOOK FOR: In COGS if CSM’s do not sell; in Sales (OpEx) if they sell. How is the department sized? ARR? Jason Lemkin has a rule of thumb of one CSM for every $2M in ARR.

- BOTTOM LINE: typically, employee-related expenses and travel.

Dev Ops

Your dev ops team has the important job of keeping your SaaS application running. In early-stage SaaS, you typically do not see heads dedicated to dev ops. They are usually staff on your engineering team or your internal IT team.

If I do have staff in R&D or my IT team handling dev ops on a regular basis, I will reclass their wages from OpEx to Dev Ops in COGS.

I also code the R&D amortization of capitalized software for-sale to dev ops.

- WHAT THEY DO: maintain hosting infrastructure (i.e., AWS, Azure), customer upgrades, and hosting service level agreements (SLA’s).

- TYPICAL EXPENSES: wages, payroll taxes, benefits, hosting, R&D amortization, third-party software embedded in our product, training, internal use software, etc.

- MARGIN: DevOps/COO is included in your recurring gross margin.

- JOB TITLES: vary; DevOps manager or engineer, release manager, systems engineer.

- WHAT TO LOOK FOR: hosting infrastructure, third-party expenses such as royalties or embedded software costs, and R&D amortization.

- BOTTOM LINE: typically, hosting and employee-related expenses.

The SaaS Chart of Accounts

At this point, we know what expenses and departments should be included in our COGS. The next step is the proper accounting set up.

Accounting is one of the foundations of financial transparency in your SaaS business. Coding expenses to COGS and by department require the proper configuration of your chart of accounts.

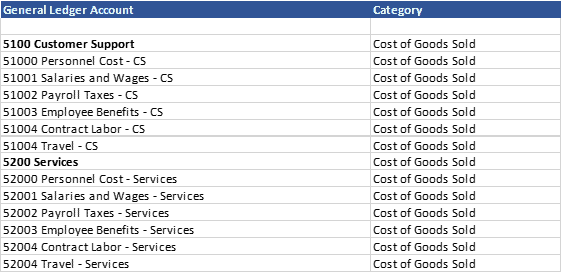

I see two common methods when structuring your chart of accounts. First, you can use an “in-line” structure to code expenses to the department level. This requires general ledger accounts specific to each department. This does duplicate a lot of accounts, however. See the picture below for an example.

When structured this way, I export the P&L from QuickBooks or Xero into a template that creates a presentation-ready SaaS P&L.

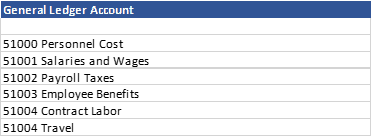

The second option is to code expenses to a general ledger account and a corresponding department. In QuickBooks, this is called a class. In other accounting systems, it’s called a dimension or department.

You do not duplicate GL accounts. For example, in the picture below you need just one wage account. A set up like this is great when hooking up your accounting system to a reporting or budget solution. It creates “multi-dimensionality” which is great for analysis. However, exports from your accounting are more tedious and sometimes require an export for each month rather than multiple months.

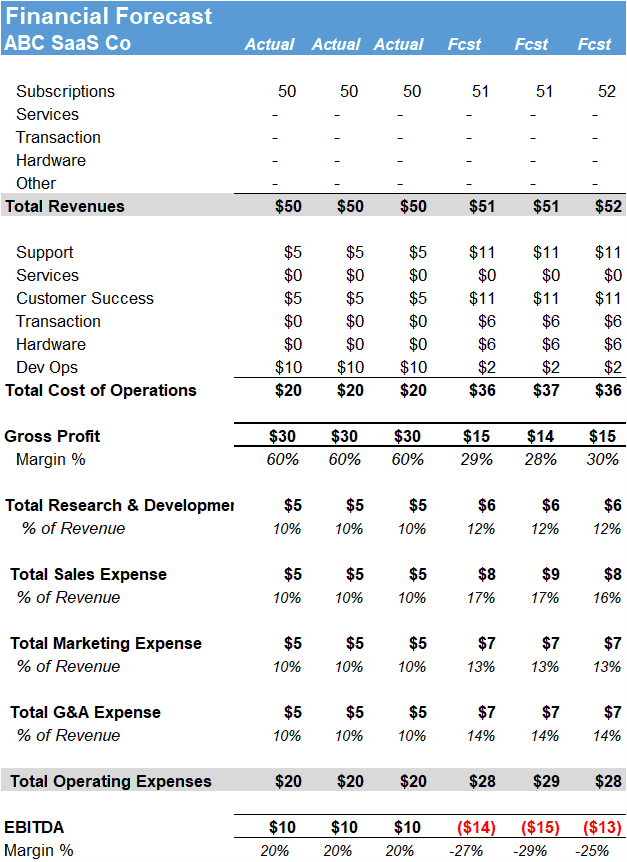

The SaaS P&L

The correct accounting foundation allows us to create a true SaaS P&L. With a SaaS P&L, we can clearly see revenue by distinct categories, COGS versus OpEx, overall gross margins, margins by revenue stream, and our OpEx profile. Yes, a lot of great information comes from the correct SaaS P&L!

Check out this post on the SaaS P&L for a detailed breakdown of all components.

SaaS Gross Margin Benchmarks

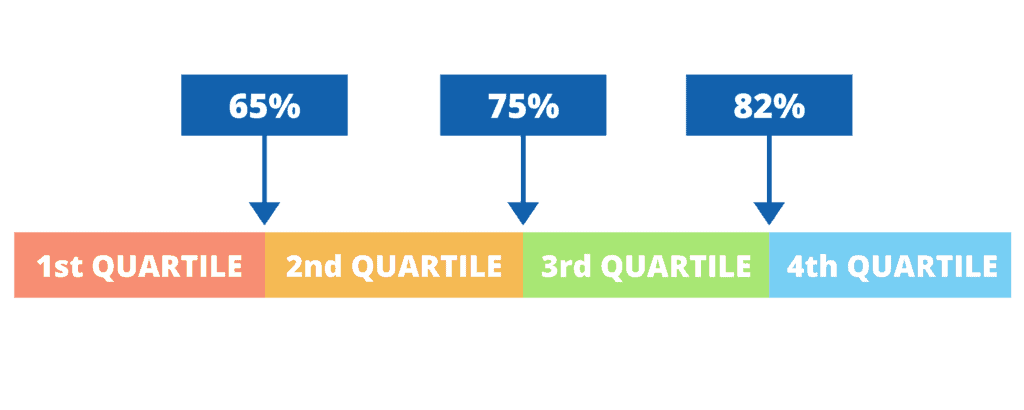

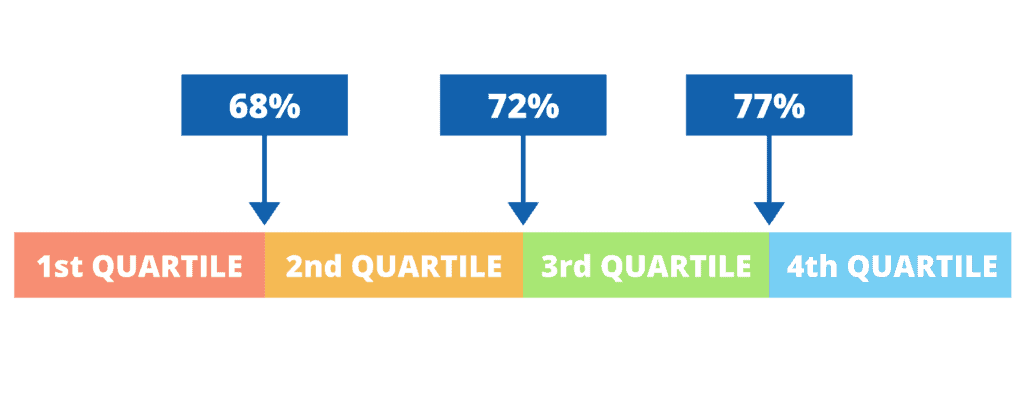

The proper chart of accounts and SaaS P&L allow us to easily benchmark our company against peers. I target an overall gross margin of 75% to 80%+ for pure-play SaaS companies. Recurring gross margin can reach as high as 90%. Professional services margins vary widely, but I believe you must make some profit in services to cover AND scale this important function.

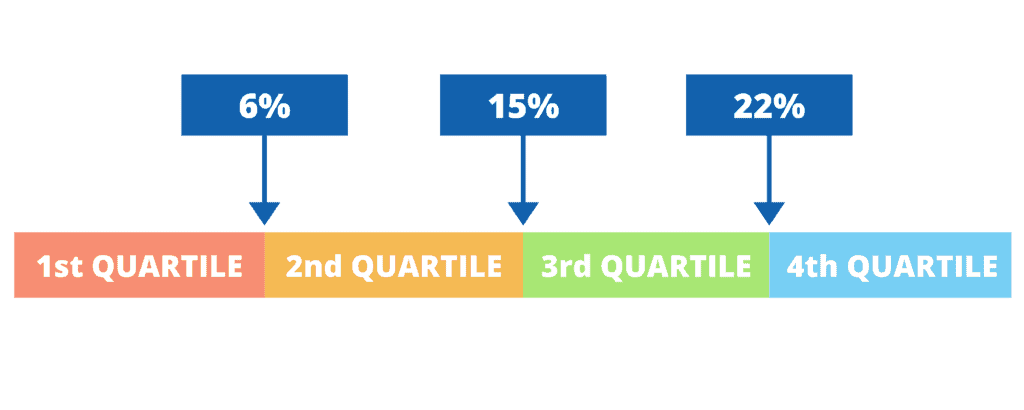

I partnered with RevOpsSquared.com to provide great SaaS benchmark data. According to their FY20 survey, median SaaS gross margins hovered at 72% with top performers at 77%.

Overall SaaS Gross Margin Benchmark

Subscription SaaS Gross Margin

Services Gross Margin

Action Items

Can you produce a SaaS P&L like the picture above? If not, it’s important for your business to improve its accounting and reporting. You are running partially blind without a SaaS P&L. You cannot understand margins and calculate key SaaS metrics.

Implement a chart of accounts structure as mentioned above to kick off the process. This requires involvement from your in-house or outsourced accounting team. If you need consulting assistance with this, please book time with me here.

Download

Download my SaaS COGS cheat sheet below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Hi Ben, thanks for the article! In my case, i have several products. How do you suggest i handle my server and support costs that are common to them in order to encode and in turn calculate gross profit per product easily .

Hi Geoffrey,

Thanks. When I create a product line P&L, I try to find an objective measure to allocate between or among products. If you don’t have a good way to allocate, revenue is a good default method to allocate expenses to different product lines. Might not be entirely accurate but a good way to start and then you can refine. Support might be easier if you know tickets by product.

Ben

Hey Ben, thanks for putting your thoughts down. I’m a Fractional CFO in Canada, and have a client that is a curated database SaaS business. There are about 8 staff that curate and maintain the database to keep it up to date, not much activity on creating new datasets. Would this salary go into cost of sales or overhead? The database being curated isn’t contractual, but is a selling feature on the website and sales etc. Wondering about the location because it affects gross margin of course. Any thoughts are helpful! Thanks!

Hi Brad,

Interesting question. If they are entering new data in the product and it is a contractual obligation to improve the dataset, I could see that being in COGS. Required expense to deliver revenue. If it is really just maintenance, that is typically in OpEx in R&D.

Ben

Thanks for the blog post, Ben!

I’ve seen a lot of companies encode “support”, “services” and “CS” under OPEX – and not under COGS.

Could you highlight why they should appear under COGS, and what would appear under OPEX?

Thanks!

HI Johnny,

I have definitely not seen services, support and CS under gross profit. Those are typically in COGS.

Ben

Hi Ben. Great article! I have a couple of questions specific to my business:

(1) We have a team that writes technical support documentation but is not customer facing themselves. Would you still include them within technical support in COGS?

(2) We have a Customer Success team who are responsible for pre-sales demos and also training/onboarding of new customers. Would we have to split the cost of pre-sales (Opex) and post-sales (COGS) for this team or could we inlcude all of this as an Opex sales expense?

Hi Jonathan,

1) I usually see technical writers coded to R&D.

2) I would split between COGS (services to onboard) and OpEx (sales responsibility to do demos)

Ben

Hi Ben, in several places you use COO. By this I’m assuming you mean Cost of Operations? Is that correct or does the acronym stand for something else? Thanks!

Hi John,

Yes, COO is Cost of Operations. Or I use Dev Ops.

Ben

Hi Ben,

Great site and post and really clear although one thing has got me puzzled. You say you ‘code the R&D amortization of capitalized software for-sale to dev ops’. However, if you do this then it isn’t an EBITDA you’ve calculated as you’ve included amortization. Am I missing something?

Hi Stuart, I had a GAAP P&L and then what I call and EBITDA P&L where I backed out all D&A.

Hello Ben,

Does amortisation of R&D fall under COGS?

Yes, R&D amortization is coded to COGS.

Hi Ben,

Do Pre-Sales and Post Sales go under COGS?

Thanks

Hi Tracy,

Sales should stay in Sales in OpEx. There could be exceptions but then you’d need to carefully define the roles and their impact on pre-sales. Now, post sales such as professional services should be in Services in COGS.

Ben