Evaluating Benchmark Misfit Risk

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

CFO Talks

MARCH 14, 2024

Understand and Mitigate Risks: A CFO must have a comprehensive understanding of the various risks the company faces, including operational, financial, and strategic risks. This involves developing risk management strategies to prevent or mitigate potential adverse impacts on the company.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Spreadym

SEPTEMBER 19, 2023

They serve as a benchmark against which actual performance is measured, and any deviations from the budget may require approval or justification. Performance Measurement Budget: Budgets are primarily used to measure actual performance against planned performance.

Spreadym

JUNE 27, 2023

These models help assess the potential outcomes of various financial decisions and aid in strategic planning, risk analysis, and sensitivity analysis. Performance Measurement: FP&A establishes performance metrics and key performance indicators (KPIs) to measure and monitor the organization's financial performance.

Spreadym

JUNE 8, 2023

Risk Assessment and Management: Identify potential financial risks and develop risk management strategies. This includes evaluating market risks, credit risks, operational risks, regulatory risks, and other factors that may impact the business's financial stability.

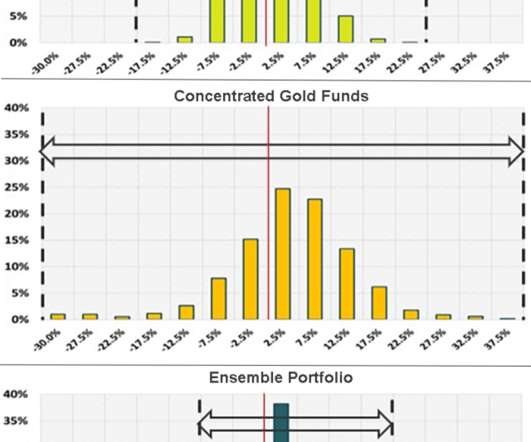

CFA Institute

JANUARY 31, 2019

What is Ensemble Active Management (EAM) and how can it help active managers outperform their benchmarks after fees?

Let's personalize your content