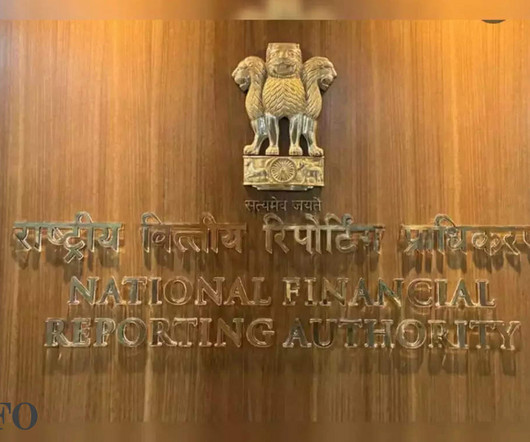

New accounting standard for insurance soon

CFO News

JULY 17, 2023

The ministry of corporate affairs (MCA) has received recommendations by the National Financial Reporting Authority (NFRA) on the Indian Accounting Standard (Ind AS) 117 for insurance contracts, he told ET."The The standards will soon be notified under the Companies (Indian Accounting Standards) Rules 2015," he added.

Let's personalize your content