Navigating uncertainty in cash flow forecasting

CFO Dive

AUGUST 22, 2022

Learn how to navigate the current volatility in cash flow forecasting by thinking long-term and strategic.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Cash Flow Forecasting Related Topics

Cash Flow Forecasting Related Topics

CFO Dive

AUGUST 22, 2022

Learn how to navigate the current volatility in cash flow forecasting by thinking long-term and strategic.

Centage

FEBRUARY 2, 2023

However, one of the most important planning tools for a business of any size is cash flow forecasting – and it’s especially important in times of uncertainty. Knowing the timing, amount and predictability of future cash flows with cash flow forecasting should be an essential component of the budgeting and planning process.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Centage

NOVEMBER 21, 2023

Having a solid grip on your cash flow forecast and reporting is one of the most important factors for any business to track. Given the current climate, paying attention to cash flow has become more vital to a business’ success than ever. Doing this can help you plan expenditures for predicted low periods.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Centage

DECEMBER 19, 2023

Cash flow forecasting provides much needed insight when preparing for known unknowns — it’s the most effective way to start future-proofing your business for the year ahead. What is a cash flow forecast?

Centage

JANUARY 31, 2022

Understanding the financial health of your organization as it stands today and measuring the strength of your cash position is critical. Cash flow forecasting provides that much needed insight and is the most effective way to start future-proofing your business for the year ahead. Learn More.

Beacon CFO Plus

SEPTEMBER 13, 2022

If you are weighing the benefits of outsourcing CFO services, consider this: Accurate cash flow forecasting can make or break your business. Cash flow forecasting involves estimating cash flow in and out during a predetermined period of time. Staying ahead of cash flow.

Centage

JULY 26, 2022

Keep reading to learn more about cash flow forecasting and discover why the companies with the most data are bound for the greatest success. Understanding Cash Flow Forecasting Even the most profitable companies can find themselves short on funds if they don’t properly manage their cash flow.

CFO Share

JULY 8, 2021

A 13 week cash flow forecast is a short term forecast used during liquidity shortfalls to plan a company’s cash flows and avoid financial distress such as missing payroll, defaulting on debt, and ending up in bankruptcy or receivership. When to use a 13 week cash flow forecast.

Onplan

DECEMBER 16, 2021

Accurate cash flow forecasting is essential. Cash is king, especially in a small, fast-growing business that may not yet be profitable. Staying on top of your cash flow helps you figure out how long your funds will last so you can make smart decisions about where to invest and where to pare back your spend.

Onplan

DECEMBER 16, 2021

Accurate cash flow forecasting is essential. Cash is king, especially in a small, fast-growing business that may not yet be profitable. Staying on top of your cash flow helps you figure out how long your funds will last so you can make smart decisions about where to invest and where to pare back your spend.

Centage

OCTOBER 28, 2021

Dynamic market conditions may not be anything new but navigating the current business environment and its unprecedented unpredictability has shined a spotlight on just how critical cash flow forecasting is to an organization. Cash is often the difference between staying in business…or not.

PYMNTS

JULY 5, 2019

In a new PYMNTS interview, Jessica Cheney, vice president, product management and strategic solutions at Bottomline Technologies , talked about the importance of improving that cash flow situation, and the role intelligent technologies can play. Cash Flow Complications.

Lime Light

SEPTEMBER 30, 2022

One of the best ways non-profit organizations can become more downturn-proof is by adopting FP&A software that enables cash flow forecasting. We’ve previously discussed the benefits of cash flow forecasting for finance teams but the non-profit space operates by entirely different rules.

CFO Selections

MAY 12, 2023

There is a misconception that business services companies do not need to prioritize cash flow management in the same way that retail businesses do because they do not have the same kind of inventory demands.

PYMNTS

MAY 22, 2019

Moody’s Corporation is partnering with the Foundation for Small Business Development (FFSBD) to connect small businesses with cash flow forecasting solutions and other financial resources.

Cube Software

APRIL 24, 2023

You need to know how much cash is coming into the business.

Driven Insights

FEBRUARY 24, 2022

He went on to share just how much time and energy he wasted worrying because he didn’t know his firm’s cash runway. The CEO of a high-growth SaaS company has plenty of things to worry about on a daily basis. One of their biggest anxieties, however, can simply be the fear of running out of money.

CFO News

SEPTEMBER 14, 2023

AI has emerged as a transformative force in cash flow forecasting and management, offering automation, precision, optimization, and skill enhancement.

CFO Share

MAY 10, 2024

By leveraging the detailed financial data they maintain, you can create a 13-week cash flow forecast that provides valuable insights into your upcoming cash obligations and helps you make better-informed decisions. All combined, bookkeepers are great assistants for 13-week cash flow forecasting.

Simply Treasury

SEPTEMBER 9, 2020

“If you have to forecast, forecast often” (Edgar R. Need for reliable forecasts. Nobody could deny the importance of having accurate and reliable Cash-Flow Forecasts (CFF). Often, we heard “ cash is king”. However, knowing if you will get cash and how much is even more important.

PYMNTS

SEPTEMBER 26, 2017

15) noted that 54 percent of small business owners don’t feel their efforts in financial planning and forecasting are effective and living up to their potential, with one-quarter noting they do not have the ability to see if their planning efforts were effective. Reports Monday (Sept.

Centage

MARCH 30, 2022

Similarly, if you’re looking to expand, investors will be interested in the amount of cash coming in each month. By improving your cash flow now, you can help prepare your business for future success. Doing this will reduce late payments and keep cash flow on the positive side.

Simply Treasury

JUNE 3, 2021

Major priorities over the next one to two years: We are not surprised that Cash-Flow Forecasting comes out on top when the COVID crisis has been hitting us for the past year. The uncertainties surrounding the economy explain the difficulty in producing reliable and accurate forecasts.

CFO Simplified

JANUARY 16, 2022

When your aging Accounts Receivable are squeezing your ability to conduct business, here are 5 action items to address the situation, ride out the temporary cash flow issues and come out the other side older, wiser and ready to address cash flow forecasting so this never happens again. . Ask for what you need.

CFO Simplified

SEPTEMBER 11, 2023

So, let’s look to see how this Cinderella report can help you plan for and understand your use of cash. The Cash Flow Forecast is a predictive tool. But first, let’s be clear on the purpose of these two documents.

Future CFO

JANUARY 26, 2024

7) Cash flow forecasting: Informed financial decisions Accurate cash flow forecasting is essential for effective financial management. AI can provide precise cash flow forecasts by analysing historical payment data and supplier behaviour.

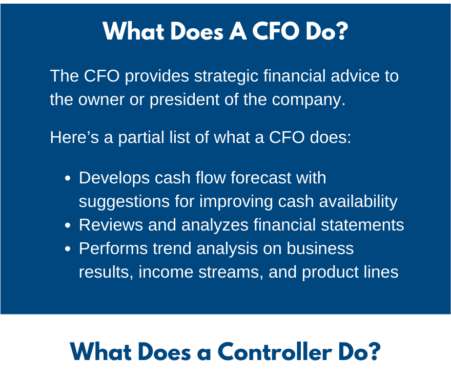

CFO Simplified

JUNE 23, 2022

Here’s a partial list of what a CFO does: Develops a cash flow forecast with suggestions for improving cash availability. He prepares information for the owner so that he can make decisions today that will affect their company’s profitability tomorrow. Reviews financial statements and evaluates changes.

The Finance Weekly

FEBRUARY 20, 2022

Understanding your company's current financial health and assessing the strength of your cash position is crucial. Cash flow forecasting provides you that much-needed knowledge and is the most efficient approach to begin future-proofing your company for the coming year. Deep drill-down capabilities.

Global Finance

JULY 26, 2024

This seamless integration allows for more-accurate cash flow forecasting, efficient liquidity management, and streamlined payment processes for an overall improved, end-to-end working capital management structure,” Sampath says.

CFO Selections

NOVEMBER 7, 2022

Nonprofits, on the other hand, are not typically as “cash flow savvy.” Some only do cash flow projections when required as a grant application stipulation, while others do not do them at all.

CS Lucas

MARCH 23, 2023

In current uncertain economic times, cash flow forecasting is becoming an ever more important tool for companies. It’s important for treasurers to continually revisit and hone their cash forecasting strategies via automation and collaborative working in these everchanging times.

PYMNTS

OCTOBER 7, 2020

Taking The Headache Out Of Cash Flow Forecasting. Wimmer said that optimizing working capital is one of clients’ biggest priorities, and its AI-based cash flow forecasting capabilities “enable them to do that at a click of a button.”. Wimmer said J.P.

Centage

OCTOBER 17, 2022

Assess your risk tolerance using cash flow forecasts for each scenario. Moreover, your cash flow likely varies from year to year and even quarter to quarter, making it necessary for you to adjust strategies. Not every company has the same tolerance for risk.

CFO Share

OCTOBER 13, 2023

Conclusion Understanding liquidity, solvency, operational efficiency, and financial planning is a strategic imperative for SMBs and startups.

The Finance Weekly

FEBRUARY 25, 2024

Ignoring the Importance of Cash Flow Forecasting Cash flow forecasting helps companies predict how much money will flow in and out of their business over a certain time. Out of every 400,000 businesses that start each year, half won't make it past five years.

PYMNTS

SEPTEMBER 4, 2019

Using accounts receivable data to accelerate the order-to-cash cycle is only part of the broader picture of cash flow management — and indeed, AR data is only part of the solution to enhanced cash flow forecasting. The Financial Consequences.

CFO Simplified

APRIL 15, 2022

A cash flow forecast was developed to manage the company’s cash shortfall. Knowing the amount of cash the company was going to have at any point in time allowed for better planning with suppliers for payments, future hiring, and buying inventory to support company growth.

The CFO Centre

JUNE 10, 2021

Cash flow problems put your company at risk. Unless your company manages cash flow effectively and uses regular cash flow forecasts, your company is in jeopardy. The post Need Help with Your Cash Flow?

CFO Simplified

NOVEMBER 14, 2022

Develop a cash flow forecast — I hope that you’re not running your company by checkbook. Let’s take a look at seven things that you should be doing regularly that will keep you from getting a bad surprise. If you are, that’s another problem that we need to discuss.

PYMNTS

MARCH 8, 2020

The improvements will be in the fields of cash flow forecasting, payments, late payments, administration and payroll compliance. QuickBooks ’ new cash flow forecasting feature, the company said, will lend business owners 30- and 90-day forecasts for cash flow, using data held within their accounts.

Spreadym

OCTOBER 13, 2023

Cash flow management is the process of tracking, analyzing, and optimizing the flow of cash into and out of a business to ensure it has enough liquidity to meet its financial obligations and achieve its strategic goals. Effective cash flow management is crucial for the financial health and sustainability of a business.

Spreadym

MAY 23, 2023

Rolling forecasts allow businesses to adapt to changing conditions and incorporate the most up-to-date data into their cash flow projections. Scenario Analysis Scenario analysis involves creating multiple cash flow forecasts based on different scenarios or assumptions.

Spreadym

JUNE 19, 2023

It involves monitoring, analyzing, and optimizing the flow of cash into and out of an entity to ensure the availability of sufficient funds for operations, expenses, and future growth. This forecast serves as a baseline for monitoring and planning your cash flow. monthly, quarterly, or annually).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content