M&A slump raises bar for seller CFOs

CFO Dive

AUGUST 3, 2023

The mergers and acquisitions boom is long over. The best CFOs are cleaning up their books and arming their CEOs with key data to win offers anyway.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Mergers and Acquisitions (M&A) Related Topics

Mergers and Acquisitions (M&A) Related Topics

CFO Dive

AUGUST 3, 2023

The mergers and acquisitions boom is long over. The best CFOs are cleaning up their books and arming their CEOs with key data to win offers anyway.

CFO Dive

SEPTEMBER 12, 2023

This year’s slow mergers and acquisitions market is having a knock-on effect on certain commercial real estate deals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

CFO Dive

APRIL 24, 2024

Despite a recent uptick in mergers and acquisitions, some buyers are nonetheless growing more guarded about tapping their retention bonus budgets.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

VCFO

MARCH 6, 2024

The Importance of HR Involvement Early in M&A Evaluation In each of the last ten years, between 18,000 and 25,000 mergers and acquisitions (M&A) deals have taken place in the United States. At the same time, Harvard Business Review notes that 70%-90% of all M&A deals fail. Are unions present?

CFO News

MARCH 18, 2024

Vaibhav Choukse, Partner & Head - Competition Law at JSA Advocates & Solicitors, said the draft rules enlist certain kinds of M&A (Merger & Acquisition) transactions which will not require approval from the CCI.

One to One

JANUARY 12, 2024

Mergers and acquisitions (M&A) are complex, high-stake transactions that demand a blend of strategic insight, financial acumen, and legal expertise. While M&A advisory firms play Read More. The post The crucial role of legal expertise in mergers and acquisitions appeared first on ONEtoONE Corporate Finance.

Future CFO

MAY 12, 2024

FutureCFO: From your bio I learnt that you became passionate about M&A at a young age. Sophie Fischer (SF): I first became passionate about merger and acquisition transactions in my teenage years in high school. I would watch my father, who worked on different M&A projects, and think: “Wow, that’s such an exciting job!”

CFO News

AUGUST 8, 2023

Due diligence, optimized technology, the ability to integrate organizational capabilities, and proper consideration of acquisition risks are the critical factors for fruitful M&A transactions.

E78 Partners

APRIL 12, 2024

When companies grow rapidly via organic and inorganic M&A, there can be a severe strain on the people, process, and technology infrastructure to support the growing enterprise. For instance, a horizontal acquisition can enable the organization to gain access to new customer segments, boosting revenues and expanding the market share.

Future CFO

NOVEMBER 26, 2023

There are five key M&A trends for 2024 while AI would reignite the global market, said WT W recently. However, the potential for disruption in 2024 remains considerable and the outlook for the M&A market hard to predict, with high borrowing costs, geopolitical conflict, and a packed election calendar around the world, WTW said.

One to One

SEPTEMBER 7, 2023

Written by Simón Restrepo, Partner at ONEtoONE Corporate Finance Colombia In the exciting world of mergers and acquisitions (M&A), conflicts of interest between company owners and employees can be challenging, particularly without established golden parachutes. Before Read More.

VCFO

NOVEMBER 18, 2021

Merger & Acquisition Integration Plans. The M&A term sheet has been negotiated, due diligence has been completed and the valuation plus the timing has been agreed upon by both sides. Why Mergers & Acquisitions Fail. Lack of an acquisition integration strategy is a sure-fire way to fail.

CFO News

FEBRUARY 20, 2024

According to a recent report by Growthpal, there has been a marginal decline in mergers and acquisitions in the fintech space in 2023, with lending leading the acquisitions with about 30 per cent, followed by payments and wealthtech. Here's what the report revealed:

Future CFO

JANUARY 18, 2024

Global M&A is set to grow again after losing steam in the final three months of 2023, said WTW recently. According to WTW’s Quarterly Deal Performance Monitor (QDPM), companies completing M&A deals in the fourth quarter of 2023—based on share price performance—underperformed the wider market by –13.6

Future CFO

NOVEMBER 19, 2023

There are several top M&A trends in 2004, according to advisory firm Gartner. The top M&A trends in 2024 identified by the research firm are as follow. The top M&A trends in 2024 identified by the research firm are as follow.

Global Finance

FEBRUARY 4, 2023

While the decline of regional banks in Japan can be traced as far back as the mid-1980s and 1990s, led mainly by a series of bankruptcies up until around 2003, the precipitous drop since the mid-1990s has been mainly due to mergers and acquisitions.

Nerd's Eye View

SEPTEMBER 19, 2023

Jessica is the Founder and Principal for Turkey Hill Management, a mergers & acquisitions consulting firm that assists financial advisors with the sale, acquisition, integration, or merger of their firms. My guest on today's podcast is Jessica Polito.

E78 Partners

JULY 3, 2023

Over the past decade, the mergers and acquisitions (M&A) landscape has evolved significantly, driven by changing economic conditions, technological advancements, and evolving strategic objectives of companies. In terms of rapid growth, M&A can provide immediate access to new markets, technologies, and customer bases.

Future CFO

FEBRUARY 5, 2023

Bold moves in global M&A might appear in 2023 — a year full of uncertainties, said Bain & Company recently when releasing its 5th annual Global Mergers & Acquisitions Report. This can be measured in the superior shareholder return of M&A active companies, the firm said.

Bramasol

JANUARY 31, 2022

This update provides a focused look on how Carbon Accounting and overall Environmental, Social and Governance (ESG) practices can significantly impact companies on both sides of Merger and Acquisition (M&A) deals. So, how does all of this play into impacting M&A activity? 1 stock holding for such funds".

Future CFO

OCTOBER 13, 2022

Global M&A performance bounced back in the third quarter of this year, said WTW recently when releasing its research on completed deals from the Quarterly Deal Performance Monitor (QDPM). Based on share price performance, buyers outclassed the wider market by +3.9 Research highlights.

Future CFO

SEPTEMBER 26, 2022

According to S&P Global , APAC M&A activity in Q1 2022 retreated from 2021’s highs, with deal value for the quarter ending at $73.8B, a decline of 44% quarter-on-quarter (QoQ) or 18% year-on-year (YoY). The financial services sector topped M&A activities in Q1 2022 with 14.6 bn) and Hong Kong (US$11.4

CFO Thought Leader

NOVEMBER 7, 2023

For corporate finance executives, few professional experiences are as adeptly converted into social currency as those manifested inside the realm of mergers and acquisitions (M&A). Laackman did not disappoint us, and what she shared reveals as much about herself as it does the human side of enterprise.

PYMNTS

DECEMBER 17, 2020

billion of consolidation deals announced in just the past four months, as a pandemic-related M&A lull ends and COVID-19 reshapes consumer demand. This acquisition is the largest in our company’s history and will allow us to continue to grow and diversify our presence in the U.S., That’s the biggest C-store deal on record.

PYMNTS

OCTOBER 2, 2020

The mergers and acquisitions, the deal-making, the funding and IPOs among payments players may be just getting started. Western Union has been public about its desire for acquisitions. Special purpose acquisition companies (SPACs) have been all the rage, too. to go public.

PYMNTS

DECEMBER 7, 2020

The conversation came against the backdrop of a muted merger landscape. Merger-related activity has been keeping pace at what had been seen in prior years, he said, citing the integration of TCF and Chemical Bank over the summer, for example. But the fear of disruption, perhaps understandably, will light a match to M&A dry powder.

PYMNTS

FEBRUARY 28, 2019

Merger and acquisition (M&A) activity continues to accelerate as 2019 progresses, both in terms of volume and value of M&A deals. Deloitte research found 79 percent of organizations expect merger activity to grow in the coming year, up from 70 percent that said the same for 2018.

Future CFO

JANUARY 31, 2023

Global M&A activity will likely rise in the second half of 2023 as investors and executives look to balance short-term risks with their long-term business transformation strategies, said PwC recently when releasing its PwC’s 2023 Global M&A Industry Trends Outlook.

PYMNTS

DECEMBER 3, 2020

The year-end acceleration of mergers and acquisitions (M&A) worldwide will keep bankers busy until the close of 2020, with deals emerging in most regions and industries, Bloomberg reported. . “It It clearly won’t be a long Christmas break for M&A bankers,” Dirk Albersmeier , co-head of M&A, J.P.

PYMNTS

JANUARY 7, 2021

This week's look at the latest in partnerships finds players in the SMB financial services landscape embracing a range of avenues to collaboration — including mergers and acquisitions (M&A) — to connect SMBs to financing, digital banking services and more. Lloyds Pilots Satago Technology. Orange Bank Acquires Anytime.

Future CFO

MAY 26, 2022

Automation in M&A. According to Reuters, global mergers and acquisitions (M&A) volumes hit a record high in 2021 , breaching the $5 trillion mark for the first time. Large companies typically have subsidiary businesses that sell to each other. Source: Dimensional Research, BlackLine 2022.

Future CFO

AUGUST 31, 2023

When it comes to the latest M&A trend, business leaders expect to see a rebound into 2024, according to EY. In addition, 59% of respondents look to M&A, while 47% look to divest and 63% look to enter strategic alliances or joint ventures, survey results indicated.

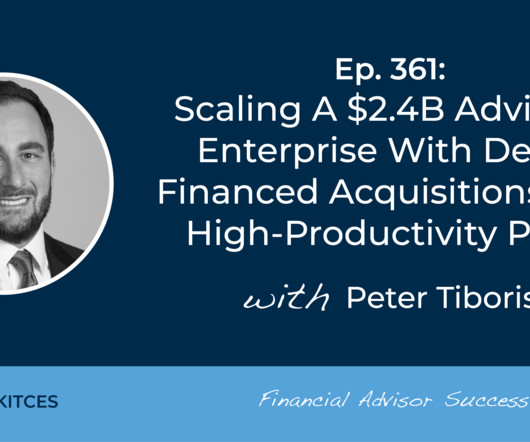

Nerd's Eye View

NOVEMBER 28, 2023

Peter is a Partner of Park Avenue Capital, an advisory firm affiliated with Northwestern Mutual based in New York City, that oversees $2.4 billion in assets under management for 1,377 client households.

Future CFO

FEBRUARY 1, 2022

M&A deal momentum is set to continue in 2022 after registering unparalleled growth in deal values and volumes in 2021, said PwC recently when releasing its Global M&A Industry Trends: 2022 Outlook. trillion, 14% higher than the start of the year – providing plenty of fuel for M&A activity in 2022. Report highlights.

Future CFO

JANUARY 17, 2023

Global M&A has a positive start in 2023 as global dealmakers achieved a second consecutive quarter of market outperformance in the last three months of 2022, said WTW recently. Global M&A highlights. In Asia Pacific, deal volumes have been more stable with a marginal increase in M&A activity during the last 12 months.

Future CFO

DECEMBER 18, 2022

When it comes to global M&A trends in 2023, WTW said that deals will be smaller while pace will be slower. As we move into 2023, economic uncertainty will continue to define and challenge M&A activity, but there will also be opportunities, said Massimo Borghello, Head of Human Capital M&A Consulting, Asia Pacific at WTW. . “In

Future CFO

MAY 30, 2023

Cross-border M&A is an important way that Asia Pacific’s top 50 consumer product companies (CP 50) adopt to expedite growth, said Bain recently. Cross-border M&A thus becomes the fastest way for Asia Pacific CPs to build business overseas, Dizon noted. International M&A activity is still heating up among CPs.

CFO News

DECEMBER 4, 2023

This move is intended to expedite the resolution of appeals in cases related to insolvency, mergers and acquisitions, and antitrust matters, reflecting the need for a robust dispute resolution system as the economy expands rapidly.

Planful

MARCH 23, 2021

During that time, he’s worked at some of the biggest names in technology and has been deeply involved in mergers and acquisitions. The post From M&A to FP&A: Keith Kim, Planful’s VP of Finance, on the Being Planful Podcast appeared first on Planful. In […].

PYMNTS

SEPTEMBER 22, 2017

Corporate mergers and acquisitions (M&A) activity has broken a new record this year, according to the latest data from Jeff Golman, vice chairman of Mesirow Financial. 21), Golman noted that not only is corporate M&A at its highest level ever, it also accounts for the largest-ever portion of total M&A activity.

Future CFO

FEBRUARY 8, 2022

There are three M&A success factors that dealmaking executives must understand to thrive in the sizzling M&A market that saw a record high value of US$5.9 trillion in 2021, said Bain & Company recently when releasing its fourth annual M&A report based on a global survey of more than 280 executives.

Future CFO

OCTOBER 3, 2023

The Association of Chartered Certified Accountants (ACCA) and the Institute for Mergers, Acquisitions, and Alliances (IMAA) signed a strategic cooperation deal to enhance their members’ corporate finance expertise. Aswath Damodaran.

Future CFO

AUGUST 11, 2022

Asia Pacific M&A activity remains robust in 2022 despite major geopolitical and financial headwinds, said EY recently when releasing results of an analysis. Elevated deal volumes and values and an increased focus within the APAC region suggests that APAC companies are leveraging M&A as a vehicle to transform their businesses.

Future CFO

NOVEMBER 21, 2021

During the launch of BCG's recent Global M&A Report, Dr. Jens Kengelbach shed light on how the M&A market responds to COVID-19 generally. The post 2021 M&A report: Mastering the art of breaking up | The M&A market responds to COVID-19 appeared first on FutureCFO.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content