2024: Business and Finance Ahead of Us

CFO News

DECEMBER 31, 2023

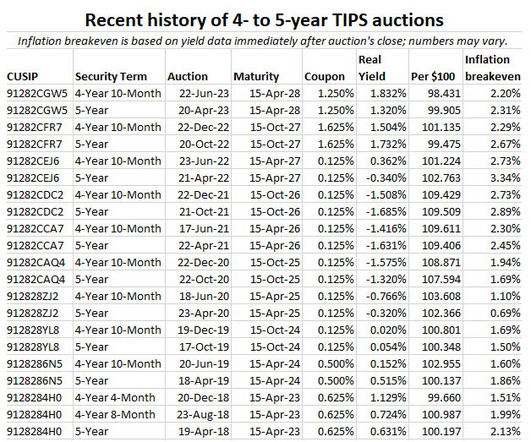

Explore the optimistic financial forecast for India in 2024 by seasoned finance expert Robin Banerjee. From increased loan availability to a rising stock market, Banerjee provides insights into the potential economic landscape. However, he cautions against global risks that could impact India's trajectory.

.jpg)

Let's personalize your content