FASB studies AI use in financial data analysis

CFO Dive

MARCH 3, 2023

The surge in use of conversational artificial intelligence has prompted scrutiny of the technology’s role in financial decisions.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Financial Data Related Topics

Financial Data Related Topics

CFO Dive

MARCH 3, 2023

The surge in use of conversational artificial intelligence has prompted scrutiny of the technology’s role in financial decisions.

Cube Software

MAY 20, 2024

Why spring cleaning is essential to finance Spring cleaning your financial data is more than a routine check—it's a critical practice that ensures healthy, efficient finance operations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

PYMNTS

AUGUST 2, 2019

In a recently reported data breach, Poshmark said it recently learned that an unauthorized third party acquired data from some users. The fashion marketplace company said the information does not include physical addresses or financial data, according to a web post.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

PYMNTS

JULY 26, 2020

The announcement by the Consumer Financial Protection Bureau ( CFPB ) comes on the heels of a symposium it held in February which included experts from consumer groups, financial technology (FinTech) companies, trade groups, banks and data aggregators.

Future CFO

FEBRUARY 15, 2021

According to Terry Smagh , senior vice president & general manager, Asia Pacific & Japan, BlackLine, the company undertook the study is to understand and recognise the critical role that financial data plays in informing businesses about strategy and continuity, the poor visibility if any, and the lack of real-time access to data.

PYMNTS

APRIL 7, 2017

The approach to financial services for consumers and businesses is quite vast, but across the spectrum, access to and management of financial data is a critical component. Finicity , a company built for financial data aggregation, is jumping into the conversation.

PYMNTS

JUNE 26, 2019

The funding comes as MX continues to build out its data solutions for financial institutions after initially launching in 2010 as a company offering banks a personal financial management solution they could provide to customers.

CFO Dive

MARCH 26, 2024

AI analytics technology is turbocharging anti-fraud measures through its ability to process oceans of financial data.

PYMNTS

MARCH 14, 2019

Cleo said in a press release this week that it will pair its integration-Platform-as-a-Service (iPaaS), Cleo Integration Cloud, with Sage’s Intacct tool, a cloud-based financial management solution for corporates.

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

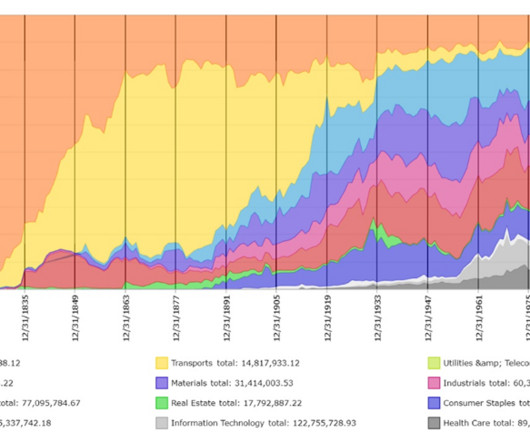

Barry Ritholtz

JUNE 17, 2024

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam points to some amazing charts from Global Financial Data. They are based on historical data that looks at 200 Years of Market Concentration. You might be surprised at the findings.

CFO Dive

MARCH 7, 2023

The majority of leaders at financial institutions say interest rates will drive business model guidance this year but few are leveraging financial data to support these changes.

CFO Dive

FEBRUARY 21, 2023

Nearly half of execs expect cyber attacks on financial data to increase in 2023, but the majority of finance leaders don't have consistent communication with their CIO to mitigate this risk.

PYMNTS

DECEMBER 8, 2019

As a way to prevent unfair competition, the Financial Stability Board (FSB) said in a report on Sunday (Dec. 8) that there should be “vigilant monitoring” of Big Tech’s move into financial services. Firms like Google, Alibaba and Facebook could be forced to share data with banks and FinTech firms.

PYMNTS

APRIL 25, 2017

The Wall Street Journal reported last week that one of the company’s investors filed suit, alleging that the company misled directors about its testing procedures, deceived investors about financial outlooks and also set up “shell” operations in order to secretly buy laboratory equipment.

PYMNTS

JULY 5, 2017

For a chief financial officer (CFO), having technology — from ERP systems to cloud accounting and cash forecasting tools — has become paramount when deploying a successful growth strategy.

PYMNTS

OCTOBER 13, 2017

Order-to-cash is an area of cash flow management that has the potential to significantly enhance a business’s financial performance.

PYMNTS

NOVEMBER 17, 2016

The CFPB is taking a closer look at consumers and the relationship to their financial records — specifically the issues they face in accessing, using, and securely sharing their financial records.

CFO Share

JUNE 18, 2024

Implement Sign-Offs and Quality Assurance from Other Departments Asking your bookkeeper to validate all financial data is unrealistic and sets them up for failure. Instead, create a system where department heads are responsible for confirming the accuracy of some data. Operations – validates inventory records.

Navigator SAP

AUGUST 19, 2022

One of the main success factors for modern enterprises is having access to real-time financial data. This can only be achieved through streamlining the process of collecting, managing, and sharing data in your organization.

Navigator SAP

MARCH 27, 2023

Fortunately, new and innovative technologies provide businesses with cutting-edge tools designed to accelerate, track and support their research processes and provide them with accurate project and financial data that they can use to improve their daily operations.

CFO Plans

MAY 16, 2024

Here’s how SaaS accounting software is revolutionizing financial management and why it’s essential for CFOs. Discover SaaS Accounting Solutions Now Real-Time Financial Data for Informed Decision-Making One of the standout features of SaaS accounting platforms is real-time access to financial data.

Future CFO

NOVEMBER 17, 2022

With external pressures that are hard to predict, real-time visibility over financial data, processes and working capital will be key to survival, leading to greater pressure on CFOs and those who report into them, according to the research.

Cube Software

JUNE 4, 2024

Prophix software: an overview Prophix (Source: G2 ) Prophix is a financial management software that facilitates financial consolidation, budgeting, analysis, planning, and reporting. The software offers a spreadsheet-style interface for analyzing financial data and organizing information.

CFO Plans

JULY 18, 2024

These services offer real-time access to financial data, enabling property managers to make quick and informed decisions. By outsourcing bookkeeping tasks, property owners can focus on core business activities while ensuring that their financial records are accurate and up-to-date.

Future CFO

JANUARY 22, 2024

Modern accounting software integrates seamlessly with diverse financial systems, automating tasks such as data entry, bank reconciliation, and invoice processing. Real-time Data Insights The advent of cloud-based accounting solutions has turned real-time financial data availability into a reality for businesses of all sizes.

Jedox Finance

JANUARY 19, 2024

Autonomous finance is increasingly permeating all aspects of financial management by optimizing and streamlining financial data gathering and analysis. Coined by industry analyst Gartner, autonomous finance refers to self-learning software agents that automate business operations and corporate finances.

Navigator SAP

MARCH 4, 2022

Some businesses only need operational support that streamlines financial data and processes. Most ERP systems can integrate all your operating and tax information to automate business processes, but you should ensure the solution aligns properly with the legal structure of your business.

FISPAN

APRIL 13, 2022

Financial data is one of the most valuable commodities in the world, and consumers have the right to control who gets access to it. Through customer-permissioned data sharing, central interfaces and the emergence of the consumer data right, consumers are the main beneficiaries of Open Banking.

The Finance Weekly

NOVEMBER 20, 2023

AI integration in their FP&A function brings various positive outcomes: AI algorithms boost efficiency by swiftly handling large amounts of financial data, reducing the , risk of errors , and enhancing data integrity. Advanced AI solutions offer real-time analysis during data entry.

Cube Software

DECEMBER 3, 2023

Understanding Planful: strengths and limitations Planful is a provider of cloud-based financial planning software that allows FP&A teams to analyze their financial data and create more insightful forecasts and reports.

FISPAN

MAY 23, 2024

As part of the Finance division, Arvin ingeniously navigates financial data to bolster business growth and serves as an internal consultant, utilizing data and metrics to enhance overall operations and strategic execution.

https://trustedcfosolutions.com/feed/

MARCH 22, 2023

You can track invoices, payments, and expenses in real time and securely access your financial data from anywhere. Sage Intacct provides centralized access to all your financial data, from bills and payment status to approvals and audit trails, so you can be sure your financial statements are accurate.

The Charity CFO

MARCH 22, 2024

Types of Data for Nonprofits The types of data a nonprofit might use for decision-making can vary between organizations. Most nonprofits will use at least one of three types of data: Financial data: Financial data includes any data relating to the finances of the organization, such as revenue or expense data.

The Charity CFO

MAY 31, 2024

Prepare for Audits Inaccurate financial data is one of the top mistakes found in nonprofit audits , but a well-organized bookkeeping system can help you be ready for an audit. This leads to more accurate financial records and reduces the risk of costly mistakes.

CFO News

NOVEMBER 24, 2023

“ The bank has been showing some financial stress for some time. A long term analysis of financial data shows that profits started falling steeply from 2016 onwards. One of the indicators is fall in profits” said a consultant to cooperative banks requesting anonymity.

Boston Startup CFO

APRIL 12, 2024

Through meticulous analysis of your historical financial data and current business operations, we will develop accurate and reliable cash flow projections, enabling you to make informed decisions, anticipate potential cash shortfalls, and implement effective strategies to maintain optimal liquidity and financial stability for your business.

Spreadym

OCTOBER 3, 2023

Budgeting and Forecasting: They have experience in creating and managing budgets, as well as forecasting financial performance based on historical data and future expectations. Strategic Thinking: FP&A candidates align financial goals with the company's strategic objectives, contributing to long-term planning and decision-making.

CFO News

JULY 9, 2023

As per the financial data accessed by Tofler, the direct-to-home (DTH) company's revenue from operations for the fiscal year dropped 5.1% to ₹4,499 crore from ₹4,741 crore a year ago. Total expenses increased by a percentage point to ₹4,691 crore from ₹4,642 crore.

PYMNTS

DECEMBER 29, 2020

Consumer Bank Chief Digital Officer Mike Naggar said the FI aims to provide customers "a choice, convenience and control of their financial data. WEX Talks Bank Partnerships To Advance B2B Payments. The company is focusing on users that may be underbanked, lacking traditional bank accounts.

CFO News

JULY 23, 2023

Top Indian companies are facing challenges due to the capital-markets regulator's new Environmental, social and governance (ESG) rules as they struggle to collate non-financial data dispersed across various internal systems, evaluate the impact of disclosing private data on sensitive governance issues, and start dealing with the complexity of capturing (..)

Cube Software

MAY 1, 2023

What is financial forecasting? Financial forecasting is a specific process where businesses take financial data from the past, apply it to the current business environment, and aim to make predictions about a company’s future financial outcomes.

Future CFO

DECEMBER 20, 2023

The most commonly identified in Singapore, and globally, is training AI models to understand and interpret complex financial data accurately (41%). Trusting the outputs of AI (34%) and ensuring robust governance frameworks to stop the potential misuse of AI (34%), were also key concerns.

CFO Plans

JULY 5, 2024

This type of software offers unparalleled flexibility and accessibility, allowing your team to access financial data from anywhere, at any time. It eliminates the constraints of traditional on-premise software and enables real-time financial management across all your operations. Learn how to secure your financial data.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content