OPEX in Financial Analysis

Spreadym

NOVEMBER 23, 2023

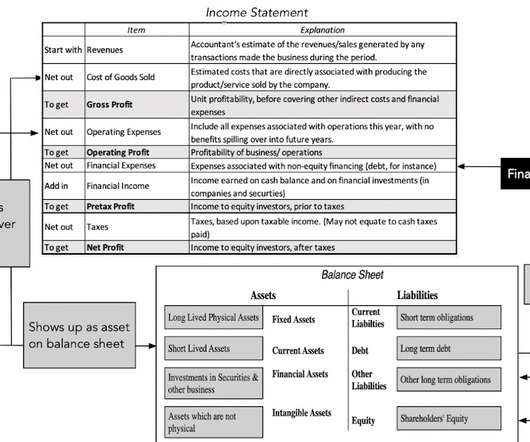

OPEX in Financial Analysis is a crucial metric as it reflects the ongoing costs necessary for running a company and generating revenue. OPEX in Financial Analysis Analyzing OPEX is essential because it provides insight into a company's operational efficiency and cost management.

Let's personalize your content