Smart corporate investing: Reduce tax bills with Investment Tax Credit transfers

CFO Dive

OCTOBER 9, 2023

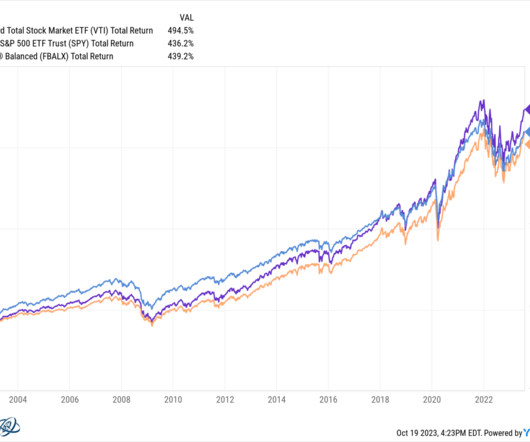

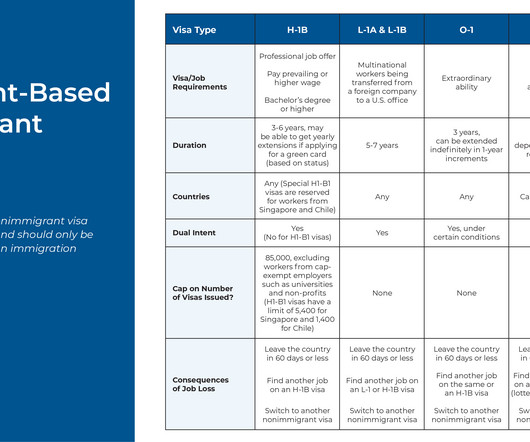

The Inflation Reduction Act created a new option: Investment tax credit (ITC) transfers. With an ITC transfer, renewable energy developers sell their ITCs to taxpaying corporations. The developer receives cash immediately, and the corporation earns a locked-in profit by buying at a discount to par.

Let's personalize your content