5 focal points for future-ready CFOs

CFO Dive

DECEMBER 4, 2023

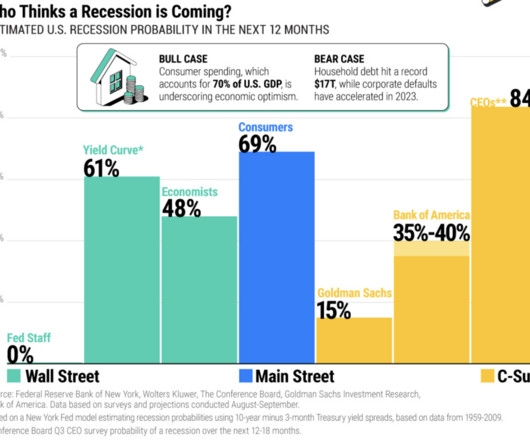

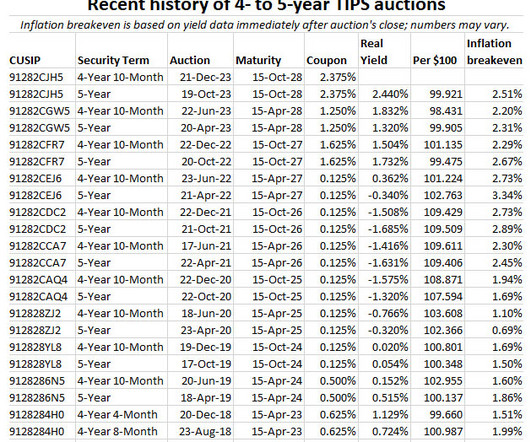

Step into the future with CFOs as they navigate a rapidly transforming financial landscape, where ESG metrics take center stage, GenAI shapes business planning and CFOs grapple with intensified priorities in data security, inflation and talent management.

.jpg)

Let's personalize your content