The Art of Financial Project Evaluation: What Makes a Project Successful?

CFO Talks

APRIL 3, 2025

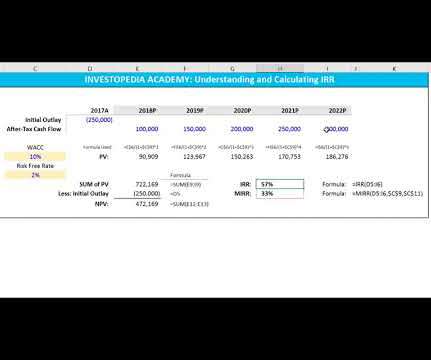

You need to know if a project will generate value. Net Present Value (NPV), Internal Rate of Return (IRR), Payback Periodthese remain essential tools in any financial leaders kit. Strategy First, Finances Second A project might look great in isolation, but does it fit your business strategy? Youre gambling.

Let's personalize your content