KKR-backed OneStream sees $4.6B valuation following $490M IPO

CFO Dive

JULY 24, 2024

The company will continue to invest in machine learning, AI and new products such as demand forecasting tools following its $490 million IPO, CFO Bill Koefoed said.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Valuation Related Topics

Valuation Related Topics

CFO Dive

JULY 24, 2024

The company will continue to invest in machine learning, AI and new products such as demand forecasting tools following its $490 million IPO, CFO Bill Koefoed said.

CFO Selections

JULY 22, 2024

A business valuation is a critical component of securing a company’s future. An experienced CFO plays a key role in any business valuation by leveraging their financial expertise to offer strategic insights along the way and ensure an accurate final assessment of the company’s value.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Barry Ritholtz

APRIL 8, 2023

A nine-time “Professor of the Year” winner at NYU, Damodaran teaches classes in corporate finance and valuation to MBA students. He has also written several books on corporate finance and equity valuation and has published widely in journals. Damdoran loves “untangling the puzzles of corporate finance and valuation.”

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

CFO News

JULY 19, 2024

Further, how does it impact investment decisions, market valuations, ease of doing business, and foreign investment? How is the Angel Tax affecting India's startup ecosystem?

CFO Dive

NOVEMBER 7, 2022

With the recent decision by US regulators to abandon plans to scrap mandatory goodwill impairment valuations, goodwill assessments are here to stay.

CFO News Room

JANUARY 15, 2023

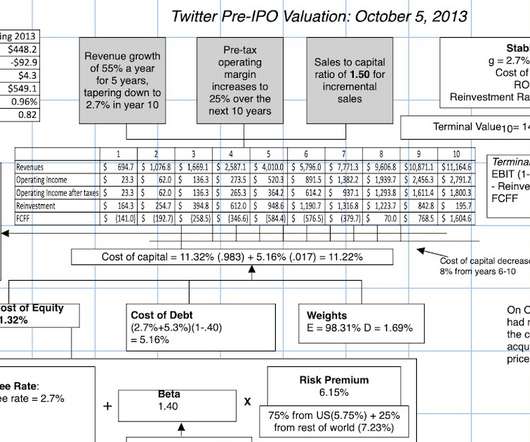

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. . billion, well below the $9.6

Fox Corporate Finance

APRIL 2, 2024

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q1 2024”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and.

VCFO

SEPTEMBER 21, 2023

Owner’s opinions of their business value can be influenced by inherent biases, flawed valuation methodologies, and factors lurking beyond their control. Owners often seek valuations from CPAs or similar entities for purposes such as insurance, estate planning, or internal events.

Fox Corporate Finance

JANUARY 23, 2024

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q4 2023”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment. Read more The post FCF Valuation Monitor – Q4 2023 published appeared first on FCF Fox Corporate Finance GmbH.

VCFO

NOVEMBER 7, 2023

How Quality of Earnings Reports Impact Valuation Securing a Quality of Earnings (QoE) report is often a routine step in the due diligence process for acquisitions. The post Quality of Earnings Reports Impact Valuation appeared first on vcfo. EBITDA is not a complete indication of financial performance for a business.

CFO Share

OCTOBER 6, 2023

Business valuation captures more than just your present position—it’s a mirror to your past efforts and a window to future possibilities. As we journey through this article, we’ll illuminate the core factors that breathe life into the valuation of your business. What factors influence business valuation?

Nerd's Eye View

MARCH 6, 2024

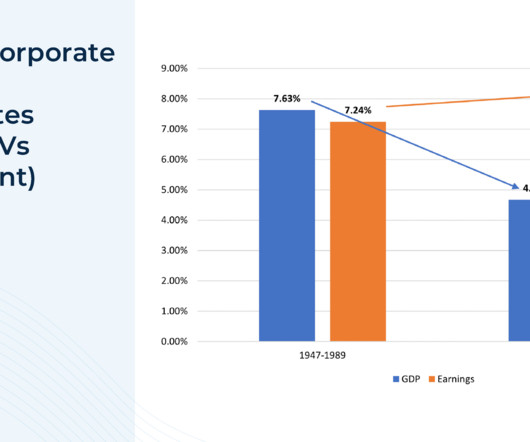

The Shilller Cyclically Adjusted Price-to-Earnings (CAPE 10) Ratio is one example that takes into account current market valuations versus company earnings, generally predicting that the higher the valuation at the beginning of a period the lower the expected return for that period.

Fox Corporate Finance

OCTOBER 26, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q3 2023”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and.

Michigan CFO

DECEMBER 28, 2022

Manufacturing business valuation is an important process that defines the value of a given manufacturing company. A company without an accurate and reliable business valuation is at a disadvantage in a competitive industry. A company without an accurate and reliable business valuation is at a disadvantage in a competitive industry.

CFO News

AUGUST 25, 2023

Zepto funding alert: The 2-year-old company has raised funds at a valuation of USD 1.4 billion making it the first unicorn of 2023 in India.

CFO News

JUNE 21, 2024

Ola Electric Mobility is encountering resistance from investors regarding its targeted valuation for the upcoming initial public offering. According to sources familiar with the matter, the company's founder is aiming for a valuation of up to $7 billion in the Mumbai listing.

Fox Corporate Finance

JULY 17, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q2 2023”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and.

Fox Corporate Finance

MAY 23, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q1 2023”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and.

CFO News

MAY 26, 2023

The finance veterans highlighted that the funding winter for Indian startups will last at least for six to nine months more, and the investment crisis has normalised the valuation of startups.

CFO News

APRIL 12, 2024

While the size of the fundraising remains undisclosed, the new round will more than double the valuation of the company. Last year in January, Blue Tokai raised USD 30 million in a Series B round at a reported valuation of around Rs 650 crore.

Fox Corporate Finance

FEBRUARY 3, 2023

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q4 2022”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and.

Musings on Markets

NOVEMBER 9, 2021

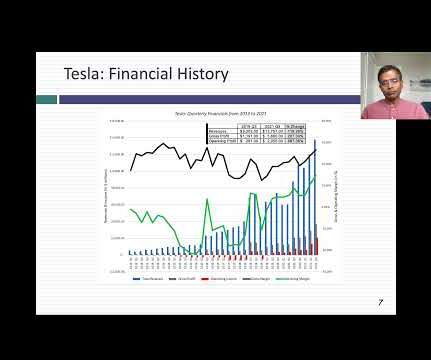

If you are interested, you can see my valuations from 2014 , 2016 and 2017. My two most recent valuations were in June 2019 and January 2020, and I am going to go back to them, not just because they are recent, but because they led to investment decisions on my part.

CFO News

APRIL 24, 2024

This round would take homegrown eyewear company Lenskart's valuation to over three times that of Warby Parker, a New York-based online retailer for spectacles and contact lens. Warby Parker listed on the NYSE late in 2022 and has a market capitalisation of around $1.55

CFO News

OCTOBER 23, 2023

Reliance Industries (RIL) and The Walt Disney Company are facing difficulties in reaching a deal for Disney's India operations due to a significant difference in their valuations. While RIL values Disney Star at $3-4 billion, Disney is seeking a valuation of $10 billion.

CFO News

OCTOBER 23, 2023

Torrent Pharma's attempt to acquire the stake of the Hamied family in Cipla has hit a roadblock due to differences in valuation. Talks between the two parties have been suspended, but may resume if they can agree on a valuation. Other potential buyers have also been deterred by the rising valuations of Cipla shares.

CFO News

APRIL 1, 2024

3 billion valuation, targeting Ebitda positivity with $1.2 Zepto eyes $300 million fundraise for $2.5-3 billion sales. Blinkit's GMV surpasses $1 billion; Zomato holds $1.5 billion cash; Swiggy prepares for IPO.

One to One

JUNE 15, 2022

The post Benefits of the valuation football field appeared first on ONEtoONE Corporate Finance.

Fox Corporate Finance

OCTOBER 14, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q3 2022”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and. The post FCF Valuation Monitor – Q3 2022 published appeared first on FCF Fox Corporate Finance GmbH.

CFO News

OCTOBER 25, 2023

Nestle India is actively seeking acquisitions that align with its existing portfolio and meet valuation expectations, according to the company's managing director, Suresh Narayanan. The food manufacturer, known for brands such as Maggi noodles and KitKat chocolate, has expressed interest in acquiring Capital Foods.

Fox Corporate Finance

JULY 15, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q2 2022”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and. The post FCF Valuation Monitor – Q2 2022 published appeared first on FCF Fox Corporate Finance GmbH.

The SaaS CFO

AUGUST 15, 2021

SaaS valuations can be a tricky subject for founders. Unfortunately, for private SaaS companies, there is only random valuation data and rules of thumb. The post SaaS Valuation Tips for Founders appeared first on The SaaS CFO. The post SaaS Valuation Tips for Founders appeared first on The SaaS CFO. To help […].

Musings on Markets

APRIL 21, 2022

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. billion, well below the $9.6

Fox Corporate Finance

APRIL 22, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q1 2022”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and. The post FCF Valuation Monitor – Q1 2022 published appeared first on FCF Fox Corporate Finance GmbH.

CFO News

DECEMBER 19, 2022

SEBI has not proceeded to get the veracity of revenue models, and valuations checked even after post listing debacle in case of various issues, says the former President at ICAI.

Fox Corporate Finance

MARCH 21, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – February 2022”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and.

Fox Corporate Finance

JANUARY 26, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q4 2021”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and. The post FCF Valuation Monitor – Q4 2021 published appeared first on FCF Fox Corporate Finance GmbH.

CFO Dive

FEBRUARY 3, 2022

If 2022 is the year investors start applying more scrutiny to the companies they fund, the value of your intangible assets can be the difference in getting, or not getting, the price you want.

CFO News

AUGUST 16, 2023

The Central Board of Direct Taxes on Wednesday released the 13 page draft form 6C, which will be used to report the inventory valuation in case of special audit of accounts directed by assessing officer.

CFO News

MAY 12, 2023

Oyo and PineLabs lose more than 50% valuation, followed by Byju's, which has lost about 48% in total. Many other startups continue to be markdown, here's a list.

CFO Dive

JULY 15, 2024

Discover how WilliamsMarston’s team of accounting, tax and valuation experts can help you navigate your most complex challenges and drive transformational outcomes.

CFO News

JULY 19, 2023

"We think the bank's current valuation of 2.9x FY24E BVPS (pure bank) does little justice to its compounding potential and low balance-sheet risk," said BNP Paribas Securities in a note to clients.

Creative CFP

AUGUST 31, 2022

We recently performed a valuation exercise for a client who intends to swap shares in a successful South African application software company for those of a similar company in the Netherlands. While these companies operate in the same industry, we found the comparative valuations to be vastly different.

CFO News

MAY 30, 2023

Fidelity had co-led Meesho's $570-million funding round along with B Capital in September 2021 at a valuation of $4.9

PYMNTS

SEPTEMBER 18, 2020

What shall we make of private fundraising rounds that make valuation leaps, tacking on billions of dollars with each new capital raise? News about Chime ’s latest funding round might give pause when comparing the tech-savvy upstart’s valuation against some traditional banking players. billion, as CNBC reported. With the $14.5

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content