The Corporate Life Cycle: Corporate Finance, Valuation and Investing Implications!

Musings on Markets

AUGUST 19, 2024

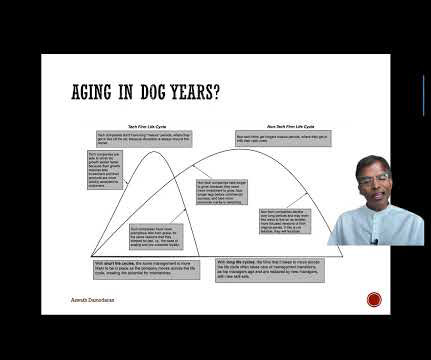

Setting the Stage The notion of a business life cycle is neither new nor original, since versions of it have floated around in management circles for decades, but its applications in finance have been spotty, with some attempts to tie where a company is in the life cycle to its corporate governance and others to accounting ratios.

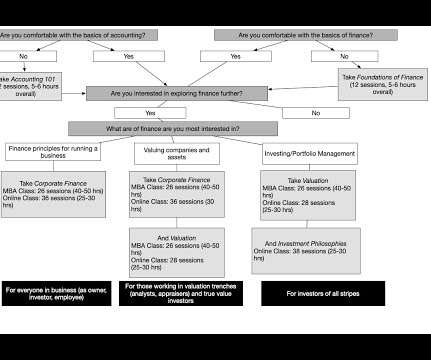

Let's personalize your content