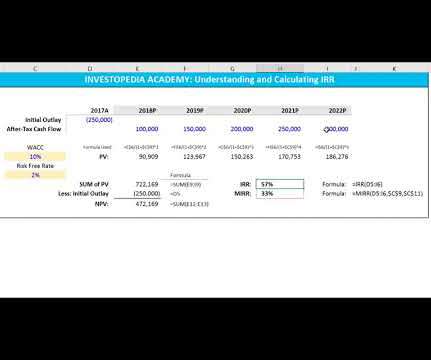

Formula for Calculating Internal Rate of Return (IRR) in Excel

CFO News Room

FEBRUARY 5, 2022

The internal rate of return (IRR) is a core component of capital budgeting and corporate finance. Businesses use it to determine which discount rate makes the present value of future after-tax cash flows equal to the initial cost of the capital investment.

Let's personalize your content