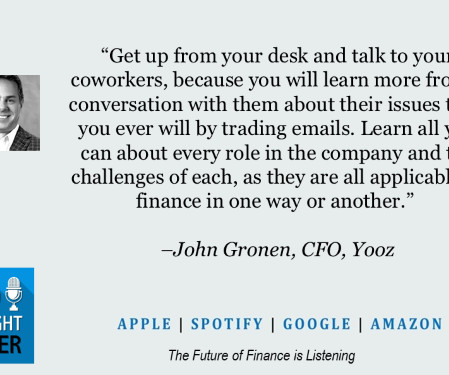

1047: Balancing Risk and Opportunity in a Changing Finance Landscape | John Gronen, CFO, Yooz

CFO Thought Leader

OCTOBER 29, 2024

The company operated two businesses: one generating about $30 million in EBITDA, while the other incurred annual losses of roughly $10 million. Gronen proposed a strategy to merge the two operations, consolidating efforts to increase profitability. Gronen: Yooz is an AP (accounts payable) automation and payments company.

Let's personalize your content