Return on Equity, Earnings Yield and Market Efficiency: Back to Basics!

Musings on Markets

FEBRUARY 18, 2025

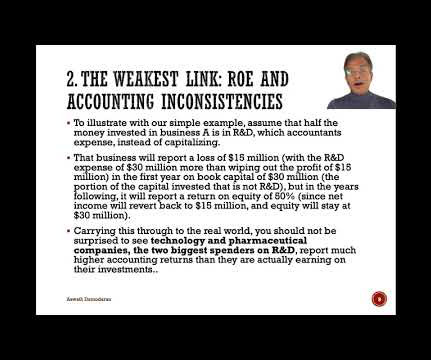

Carrying this through to the real world, you should not be surprised to see technology and pharmaceutical companies, the two biggest spenders on R&D, report much higher accounting returns than they are actually earning on their investments.

Let's personalize your content