Strategic Finance Focus at Year-End

VCFO

NOVEMBER 1, 2023

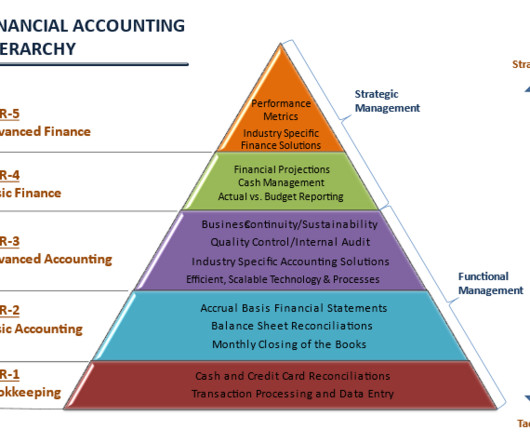

Assessing Accounting For entities preparing GAAP compliant financial statements, adoption of Revenue Recognition Standard (ASC 606) and Lease Accounting Standard (ASC 842) is now mandatory. audited or reviewed financial statements). It is critical to engage in strategic planning for the year ahead.

Let's personalize your content