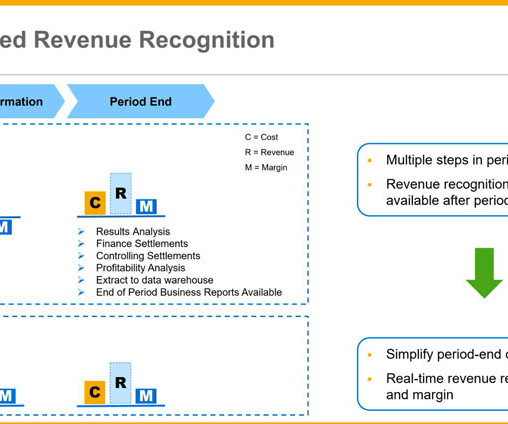

Integrating RevRec and Cost Accounting in the SAP Public Cloud

Bramasol

AUGUST 31, 2023

Over the past eight years, many episodes in this blog series have focused on revenue recognition and how SAP solutions such as Revenue Accounting and Reporting (RAR) have provided a robust foundation for compliance with ASC 606 and IFRS 15.

Let's personalize your content