5 Questions Using Risk Assessment Data That Help Advisors Understand Clients’ True Concerns About Risk

Nerd's Eye View

MAY 8, 2024

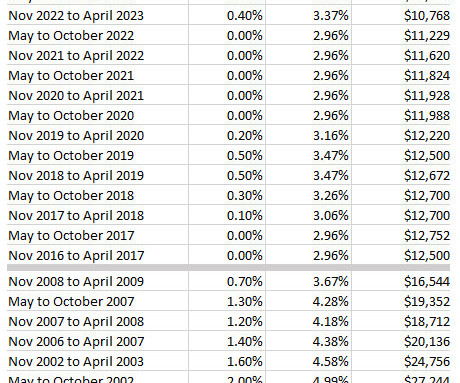

Measuring a client's tolerance for risk is an essential (and required!) step when onboarding a new client, as making any sort of recommendation is impossible without first understanding how comfortable clients may be when their portfolios inevitably experience volatility. Over the years, 2 types of measurement tools have emerged as the standards for assessing risk tolerance: 1) psychometric tests, which feature a series of questions (such as, "What amount of risk do you feel you have taken with

.jpg)

Let's personalize your content