Where Can FP&A Career Path Take You?

Fpanda Club

SEPTEMBER 2, 2021

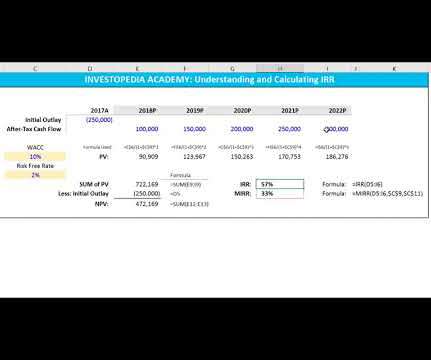

This process usually presumes the close collaboration of FP&A teams with business leaders and executives to align goals and expectations and create a common financial model of future revenues, costs and cash flows based on the external and internal factors and conditions.

Let's personalize your content