Evaluating Benchmark Misfit Risk

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

CFA Institute

DECEMBER 19, 2021

Beating a passive benchmark is hard. And that's true for both reindeer and people.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Spreadym

JUNE 8, 2023

It is a tool used to anticipate the financial performance of a business or a specific project. Forecasts can be short-term or long-term and are usually based on assumptions about factors like market conditions, customer behavior, economic trends, and internal capabilities. Clear goals help shape your budgeting priorities.

CFA Institute

APRIL 21, 2021

There is no valid benchmark for the unlisted private equity sector. That needs to change.

CFA Institute

JANUARY 13, 2021

PE results can neither be benchmarked reliably nor delivered consistently.

CFA Institute

MARCH 15, 2019

Why do the benchmark indices in India and the United States display completely opposite trends relative to GDP growth?

CFA Institute

JANUARY 31, 2019

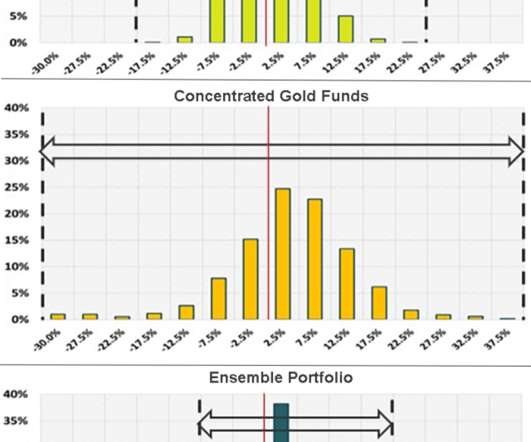

What is Ensemble Active Management (EAM) and how can it help active managers outperform their benchmarks after fees?

Let's personalize your content