Musings on Markets: Data Update 5 for 2022: The Bottom Line!

CFO News Room

JANUARY 18, 2023

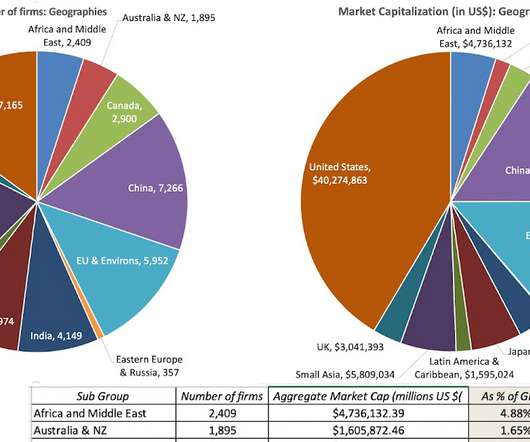

In my last post, I noted the decline in costs of capital for firms over time, noting that the median cost of capital at the start of 2022 is only 6.33%, across global firms, and argued that companies that demand double-digit hurdle rates risk being shut out of investments.

Let's personalize your content