The Corporate Life Cycle: Corporate Finance, Valuation and Investing Implications!

Musings on Markets

AUGUST 19, 2024

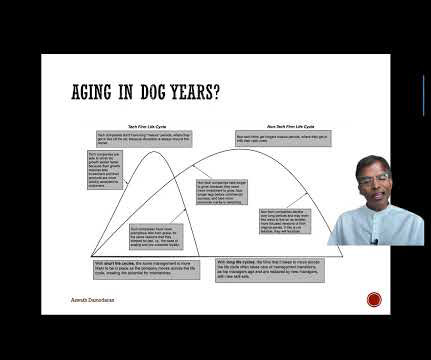

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. Advice on concentrating your portfolio and having a margin of safety, both value investing nostrums, may work with the former but not with the latter.

Let's personalize your content