In Search of Safe Havens: The Trust Deficit and Risk-free Investments!

Musings on Markets

AUGUST 15, 2023

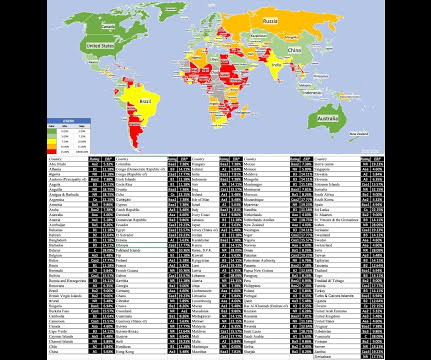

I was reminded of that paper a few weeks ago, when Fitch downgraded the US, from AAA to AA+, a relatively minor shift, but one with significant psychological consequences for investors in the largest economy in the world, whose currency still dominates global transactions. and the reverse will occur, when risk-free rates drop.

Let's personalize your content