Data Update 4 for 2024: Danger and Opportunity - Bringing Risk into the Equation!

Musings on Markets

JANUARY 28, 2024

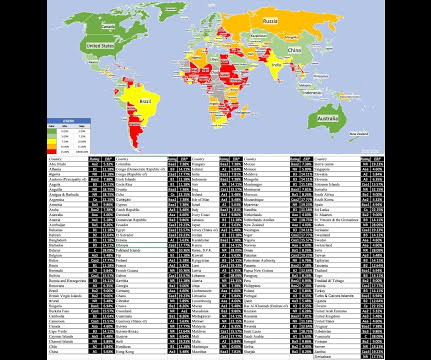

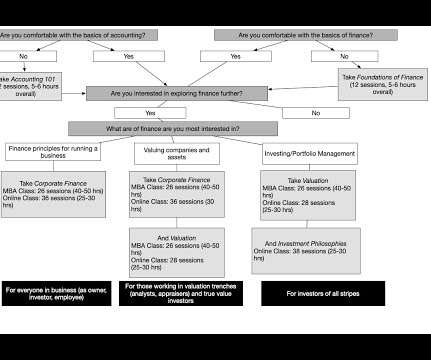

In this post, I look at risk, a central theme in finance and investing, but one that is surprisingly misunderstood and misconstrued. Risk Measures There is almost no conversation or discussion that you can have about business or investing, where risk is not a part of that discussion. What is risk?

Let's personalize your content