Marking Time: A new year, a fresh semester and its class time!

Musings on Markets

JANUARY 12, 2021

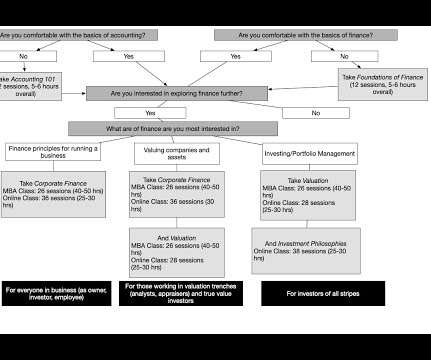

I end the class with a corporate finance version of valuation, where I tie inputs into value (cash flows, growth and risk) to investment, financing and dividend decisions. Valuation : It is unfortunate, but for most people, the vision that comes to mind when I say that I teach valuation is excel spreadsheets and high profile company names.

Let's personalize your content