Breach of Trust: Decoding the Banking Crisis

Musings on Markets

MAY 5, 2023

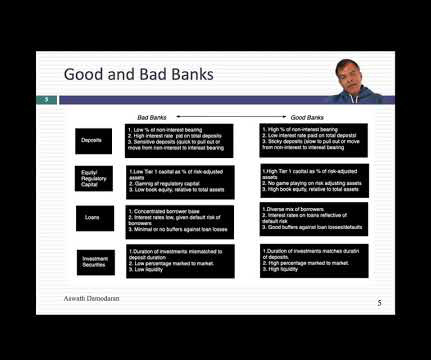

A bank collects deposits from customers, offering the quid quo pro of convenience, safety and sometimes interest income (on those deposits that are interest-beating) and either lends this money out to borrowers (individuals and businesses), charging an interest rate that is high enough to cover defaults and leave a surplus profit for the bank.

Let's personalize your content