Gender Lens Investing: Asset Managers and Women in Leadership

CFA Institute

OCTOBER 6, 2021

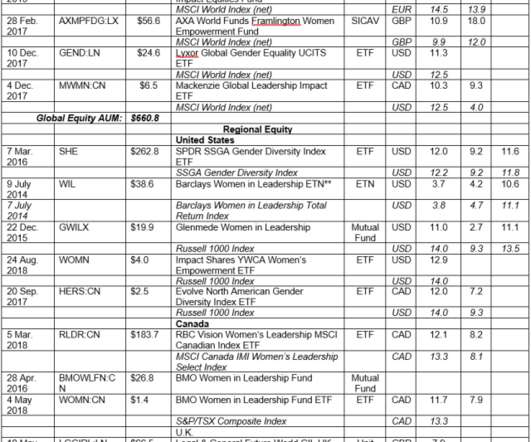

Global asset managers have a range of stewardship policies and statements in place to support growth in corporate women in leadership (WIL). But is it enough?

Let's personalize your content