Do Nonprofits Use Cash or Accrual Accounting?

The Charity CFO

APRIL 5, 2022

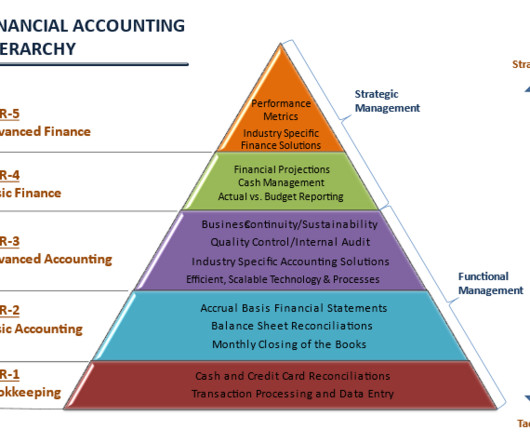

Furthermore, accrual accounting is required by Generally Accepted Accounting Principles ( GAAP ) because it gives you a more accurate picture of your organization’s fiscal situation and allows for easier side-by-side comparison with financial statements of other organizations. Common accrual accounts include: .

Let's personalize your content