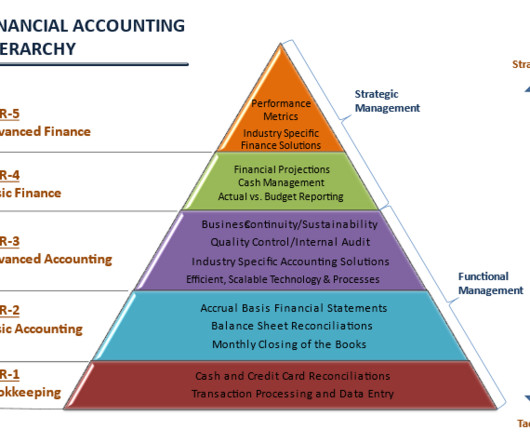

Financial Accounting Hierarchy - By JP Puchulu

Boston Startup CFO

APRIL 3, 2023

As a trailblazer exploring unknown territories, you must equip yourself with the appropriate knowledge and tools to make educated decisions that guide your enterprise towards success. Fortunately, we present you with a compass – a diagram that demystifies the functions of financial accounting.

Let's personalize your content