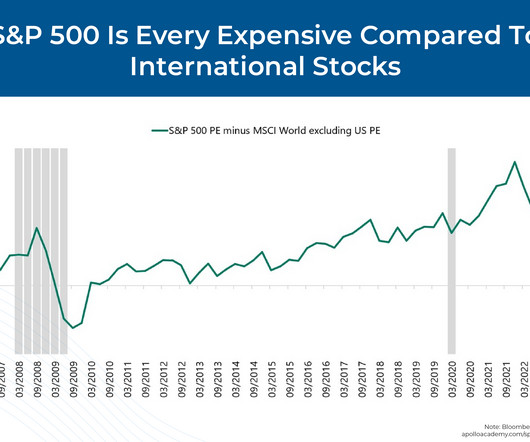

Retail lending Edict — Duration Risk & Credit Risk

CFO News

JANUARY 7, 2024

Ashish Goyal, Co-founder & CFO of Fibe, explores the critical decision fund managers face between duration and credit risk in financial management. Balancing these risks is essential for optimal outcomes in diverse economic landscapes.

Let's personalize your content