CFO vs Controller – What’s the Difference?

CFO Simplified

JUNE 23, 2022

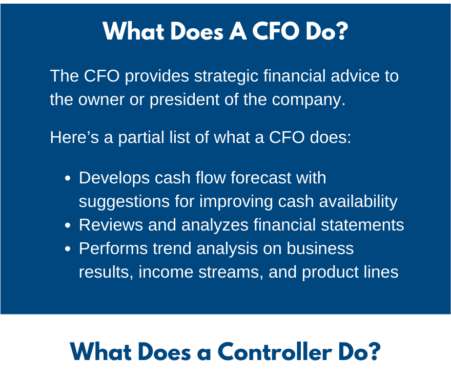

It’s not unusual in a small company for the accounting manager to become the controller and then become the CFO. Here’s a list of ten tactical things that a controller does: Maintains the company’s bank balance. Reconciles the bank accounts. Codes and processes Accounts Payable invoices.

Let's personalize your content