Rein in rogue spending by automating accounts payable

Future CFO

MARCH 27, 2023

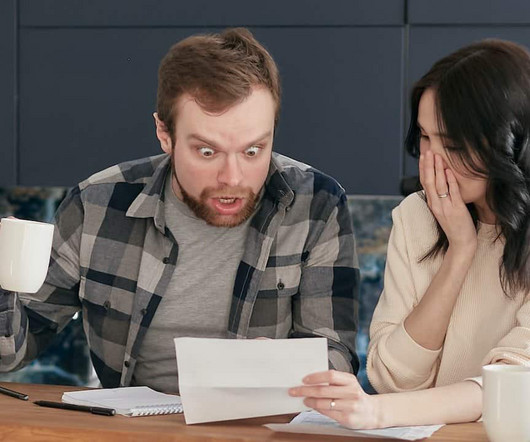

As businesses usher in a new year, the uncertain economic climate has dampened some of the enthusiasm that spurred the first months of the post-pandemic recovery. To curb rogue spending, businesses need to rethink how the accounts payable (AP) process can be improved.

Let's personalize your content