CFO vs Controller – What’s the Difference?

CFO Simplified

JUNE 23, 2022

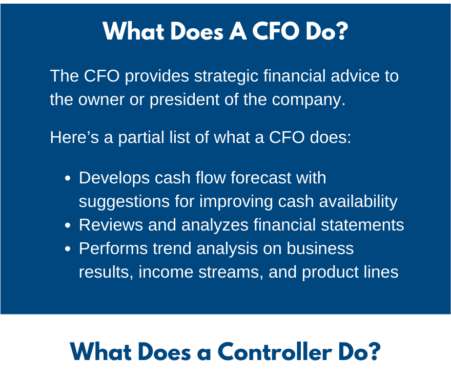

Reconciles the bank accounts. Codes and processes Accounts Payable invoices. Issues Accounts Payable checks. Here’s a partial list of what a CFO does: Develops a cash flow forecast with suggestions for improving cash availability. Calculates and enters payroll.

Let's personalize your content