From Controller to CFO: What Changes?

CFO Talks

MARCH 20, 2024

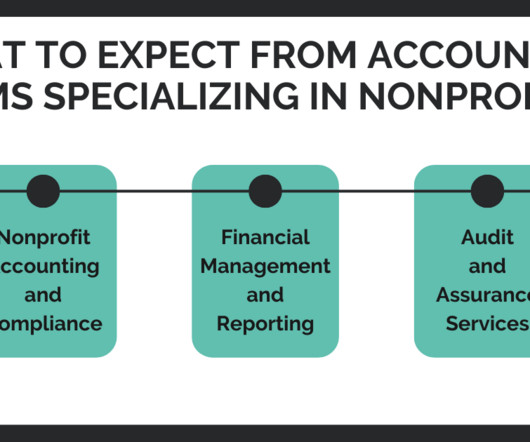

It’s about making plans for the company’s financial future and finding ways to make the business better. Example: When it’s time for an audit, the Controller is hands-on, working directly with the auditors, showing them the books, and explaining the details. Budgeting: The Controller gathers info and puts the budget together.

Let's personalize your content