Business lobby rips Biden’s stock buyback tax plan

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Tax Planning Related Topics

Tax Planning Related Topics

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

CFA Institute

JANUARY 13, 2023

While risk management may be the key component of wealth preservation, what often gets overlooked is how much smart tax planning can do to help clients retain more of their wealth. After a down year for financial markets, investors’ priorities have naturally shifted from growing their assets to preserving their wealth.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Nerd's Eye View

NOVEMBER 30, 2022

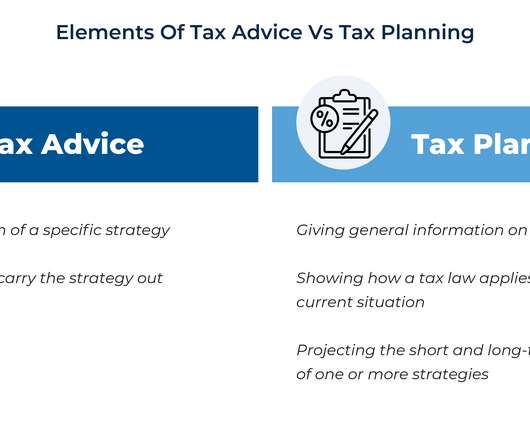

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

CFO Dive

JUNE 27, 2022

Hungary’s eleventh hour opposition included concerns about the war in Ukraine and fears about being a first mover on the Pillar Two rules, according to a PwC report.

CFO News

NOVEMBER 24, 2023

Dhankhar stressed that tax evasion and financial frauds endanger the financial stability and economic growth of the economy. “As As watchdogs, your capacity is potent enough to contain these,” he told the gathering of CAs.

CFO News

MARCH 15, 2023

The Indian government is unlikely to make changes to its budget proposal of taxing the total returns on high-value life insurance policies, two government officials said on Wednesday, amid demands by insurance companies to reconsider the move.

CFO News Room

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

CFO Plans

JUNE 27, 2024

Expert Tax Planning and Preparation for Savings Navigating the complexities of tax regulations can be daunting for any business. Certified public accountants (CPAs) within outsourced accounting firms offer expert tax planning and preparation services. Get expert tax planning and maximize your savings.

PYMNTS

AUGUST 26, 2019

Thailand hopes to annually collect 3 billion to 4 billion baht ($98 million to $131 million) by introducing a tax on tech businesses, Reuters reported on Monday (Aug. If approved by Parliament, Thailand will institute a value-added-tax starting next year on electronic businesses, leveraging the eCommerce boom in the country.

PYMNTS

OCTOBER 19, 2020

However, the OECD cautioned about the potential of an international trade war brought by different nations rolling out digital services taxes on their own to assist in their economic rebounds from COVID-19 in the event nations don’t all agree on the new tax regulations. France Will Proceed With Controversial Digital Services Tax Plan.

Navigator SAP

OCTOBER 28, 2022

Like tax planning, landed costs are a subtle but important business consideration for maximizing profit margins and ensuring profitability. It seemed like an efficient purchase order. A batch of camera equipment was ordered from a UK supplier for a warehouse in Thailand based on a good unit price.

CFO Plans

JUNE 13, 2024

Enhance Your Financial Reporting with Expert CFO Services Effective Tax Planning and Preparation Tax planning and preparation can significantly impact a company’s bottom line. Fractional CFOs offer expert guidance on tax strategies, ensuring compliance and optimizing tax liabilities.

CFO Plans

JUNE 7, 2024

Enhance Your Financial Reporting with Expert CFO Services Effective Tax Planning and Preparation Tax planning and preparation can significantly impact a company’s bottom line. Fractional CFOs offer expert guidance on tax strategies, ensuring compliance and optimizing tax liabilities.

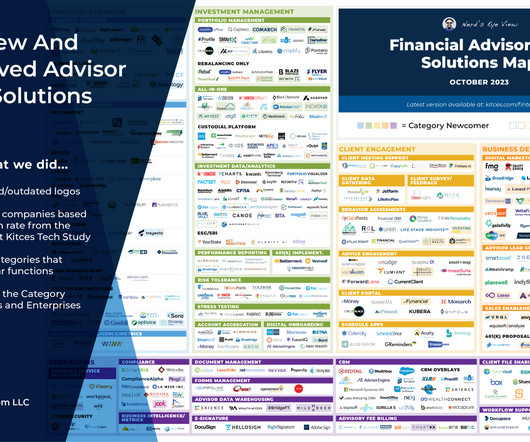

Nerd's Eye View

DECEMBER 22, 2023

Also in industry news this week: The SEC has been sending letters to advisory firms requesting details on their use of AI technology, raising questions about whether they may be considering revising their proposed AI rule that received significant pushback earlier this year for the wide breadth of the types of technology it covers DPL Financial has (..)

Nerd's Eye View

JANUARY 8, 2024

improves on the previous iterations of planning by involving a more thorough technical analysis of a client's unique situation than it did before and drilling deeper to reveal more planning opportunities to present to clients. Specifically, Financial Advice 3.0

Anaplan

FEBRUARY 12, 2021

The planning disconnect Every time a new year rolls around, many of us take it as an opportunity to reorder our lives. Reorganize closets or refrigerators, create an emergency go-bag, get ahead of tax planning so that the weekend before the filing deadline you’re not frantically pawing through a year’s worth of receipts – you […].

Nerd's Eye View

JUNE 21, 2024

Also in industry news this week: A recent survey indicates that financial advisors continue to move towards ETFs and away from mutual funds when it comes to client portfolio recommendations, though a majority of advisors continue to see a role for active management in the investment management process A former employee has filed a lawsuit alleging (..)

Nerd's Eye View

OCTOBER 27, 2023

Also in industry news this week: A survey indicates that while financial advisors remain the most trusted source of financial advice, they might increasingly encounter client questions and ideas that originated from social media Following the transition of advisors and clients from TD Ameritrade and amid competition from competing RIA custodians, Charles (..)

Nerd's Eye View

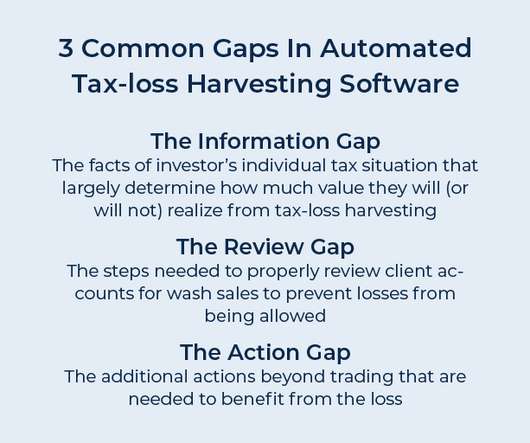

OCTOBER 5, 2022

And when factoring in the fees charged by those technology platforms, the value of such ‘tactical’ tax-loss harvesting might exceed the value the investor would have realized by relying on a technology solution to do it automatically! Read More.

Anaplan

FEBRUARY 12, 2021

The planning disconnect Every time a new year begins, many of us take it as an opportunity to reorder our lives. Reorganize closets or refrigerators, create an emergency go-bag, get ahead of tax planning so that the weekend before the filing deadline you’re not frantically pawing through a year’s worth of receipts – you get […].

CFO Plans

JUNE 14, 2024

These services include cash flow analysis, tax planning, and risk management, ensuring that your real estate portfolio remains profitable and sustainable. Case Study: A real estate investment firm utilized specialized financial services to manage a diverse portfolio of commercial properties.

CFO Network

NOVEMBER 10, 2021

With outsourced business accounting services , you can get access to professional tax planning advice from a CPA or a CFO. They will be able to advise you on what tax planning strategies to put in place to legally minimize your tax burden each year. You Get Valuable Advice for Your Small Business.

Nerd's Eye View

JULY 12, 2024

Also in industry news this week: 2 House committees this week advanced legislation that would halt implementation of the Department of Labor's new Retirement Security Rule, which, combined with ongoing lawsuits, threaten to derail the regulation either before or soon after it becomes effective in late September A Federal judge has put the future of (..)

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Nerd's Eye View

JULY 7, 2023

Also in industry news this week: A recent survey indicates that a strong majority of financial advisory clients have maintained their trust in their advisors despite the investment market setbacks experienced last year A report from the SEC shows that a majority RIAs have mandatory arbitration clauses in their client agreements, a practice that has (..)

Nerd's Eye View

FEBRUARY 24, 2023

Also in industry news this week: Why the behavior of some TAMPs and investment advisers might have led the SEC to propose its new (and potentially burdensome) ‘outsourcing rule’ Why independent broker-dealers could become major players in RIA M&A in the coming year From there, we have several articles on advisor marketing: How to craft (..)

CFO Share

MAY 18, 2023

VAT vs sales tax can be especially confusing for international businesses. Sales tax is extremely common amongst the USA, whereas VAT is more common in foreign countries. All companies should consider VAT vs sales tax when reviewing their tax planning strategy. Who implements a VAT or sales tax?

Nerd's Eye View

JULY 24, 2024

As a whole, these regulations introduce significantly more complexity to the process of tax planning around retirement accounts, particularly after the death of the account's original owner.

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions. Those individuals and entities are not required to report beneficial ownership information to FinCEN at this time.

Spreadym

APRIL 27, 2023

Tax planning: Some financial analysis and planning software includes tax planning tools that help users forecast and minimize tax liabilities and maximize tax deductions. It can be important that FA&P software can generate financial reports by several standards.

Nerd's Eye View

MAY 31, 2024

House of Representatives and is now being considered in the Senate would increase the number of firms classified as “small entities” and would require the SEC to assess the impact of proposed regulation on this newly enlarged class of investment advisers (which tend to have fewer compliance staff and resources available compared to larger (..)

Nerd's Eye View

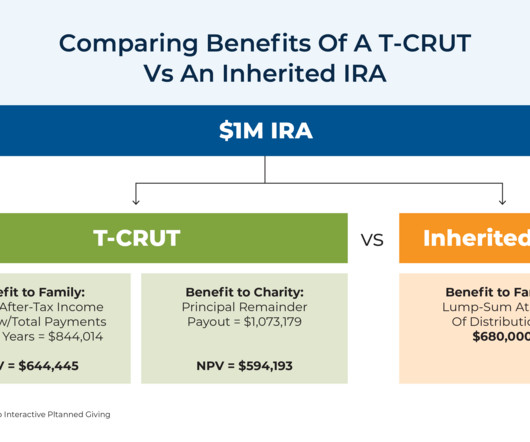

JANUARY 31, 2024

This shift has led financial advisors to explore new strategies for mitigating the resulting tax-planning challenges. Under the new law, non-spouse beneficiaries (with few exceptions) must now withdraw the entirety of an inherited IRA within 10 years of the account owner's passing rather than over their own lifetimes.

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions. Those individuals and entities are not required to report beneficial ownership information to FinCEN at this time.

Nerd's Eye View

JULY 24, 2024

As a whole, these regulations introduce significantly more complexity to the process of tax planning around retirement accounts, particularly after the death of the account's original owner.

Nerd's Eye View

OCTOBER 14, 2022

While this will help seniors keep pace with rising prices, it also creates tax planning opportunities for advisors and raises the possibility that the Social Security Trust Fund could be depleted sooner than expected. for 2023, the largest COLA since 1981.

CFO Plans

JULY 18, 2024

Expert real estate accounting services can help property owners navigate the complexities of tax laws, identify potential deductions, and avoid costly penalties. Explore our strategic tax planning services. Case Study: A commercial real estate investor faced significant tax liabilities due to improper planning.

Nerd's Eye View

MAY 12, 2023

Also in industry news this week: Why industry groups representing investment advisers and others have blasted an SEC proposal that would significantly expand its Custody Rule A new study suggests that organic client growth and profit margins are the key factors driving RIA valuations, with the firm’s affiliation model having little to no impact (..)

Nerd's Eye View

NOVEMBER 18, 2022

A potential compromise during the lame-duck Congressional session could see a boost to the child tax credit and extended tax breaks for businesses. From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions.

Nerd's Eye View

NOVEMBER 1, 2023

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. Part of this value is understanding the detailed nuances that make a strategy effective and implementing it correctly, avoiding issues with the IRS down the line.

Nerd's Eye View

DECEMBER 25, 2023

We start with several articles on retirement planning: Data showing where American retirees currently stand, from their average net worth to how they spend each hour of the day How, according to a recent study, delaying Social Security benefits typically leads to greater lifetime wealth than claiming benefits early in order to reduce portfolio withdrawals (..)

Nerd's Eye View

AUGUST 21, 2023

tax planning or working with blended families), as well as the type of clients they like working with the most. First, an advisor can consider the many niche options from which to choose, including professional (e.g., doctors or employees of a certain company), technical (e.g., equity compensation), values-based (e.g.,

Nerd's Eye View

OCTOBER 2, 2023

This month's edition kicks off with the news that custodial platform Altruist is eliminating the $1 per account monthly fee for its portfolio management and reporting technology for advisors on its platform, which on the one hand suggests that the economies of scale Altruist has achieved in the wake of its move to become a fully self-clearing custodian (..)

Nerd's Eye View

SEPTEMBER 6, 2023

Beyond insurance, advisors and their clients can also consider options such as the use of corporate entities such as Limited Liability Companies (LLCs) for business interests, and estate tax planning tools such as Spousal Lifetime Access Trusts (SLATs) that can offer both estate planning and asset protection benefits for married couples.

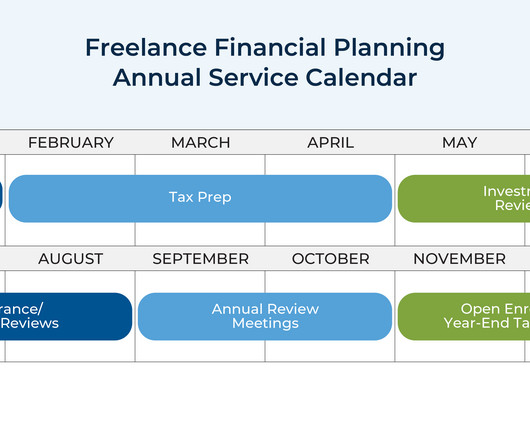

Nerd's Eye View

MAY 8, 2023

investment reviews in the summer, retirement projection updates in the fall, and year-end tax planning in the winter) created enough efficiency through systematizing the ongoing financial planning process that allowed him to fit in tax preparation without reducing any of his other service offerings!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content