The unfair terms prohibition in Article 5.52 of the new Civil Code and financial services in a B2B context: balancing fairness with legal certainty

Corporate Finance Lab

DECEMBER 5, 2022

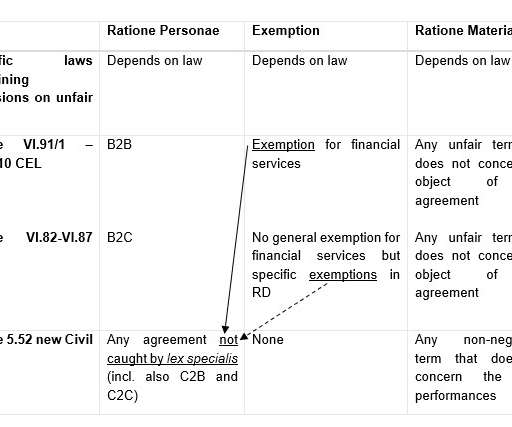

Before that, the B2B and B2C legislation had already introduced a similar prohibition, but financial services had been (partially) exempted. Such exemption for financial services, however, does not appear in the new Civil Code. of the new Civil Code, the B2B and the B2C regime. Unfair terms: Article 5.52 Article 5.52

Let's personalize your content