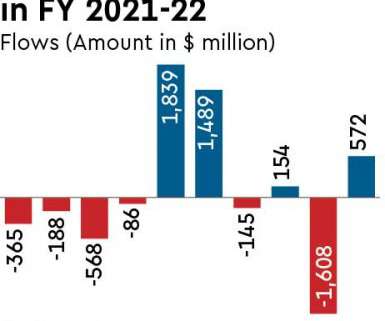

FPIs turn net buyers of debt worth $571.65 million in January

CFO News Room

FEBRUARY 6, 2022

Domestic yields have risen more than 15 basis points in the past few days, driven largely by a sharp rise in Brent crude oil prices in the international market and an uptick in US Treasury yields on the expectation that Fed will hike rates more aggressively than expected.

Let's personalize your content