The Sharing Economy come home: The IPO of Airbnb!

Musings on Markets

DECEMBER 2, 2020

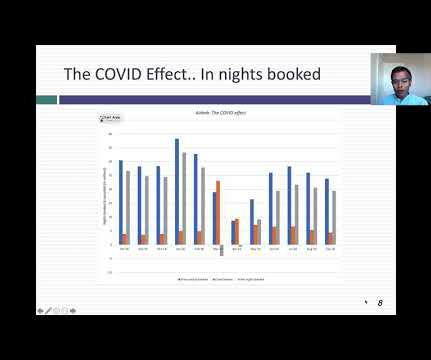

Setting the Table As with any valuation, the first step in valuing Airbnb is trying to understand its history and its business model, including how it has navigated the economic consequences of the COVID. In addition, growth in the experiences business will also push this metric upwards, since Airbnb keeps a 20% share of those revenues.

Let's personalize your content