The Best Practices to Create Operating Budget

Spreadym

AUGUST 8, 2023

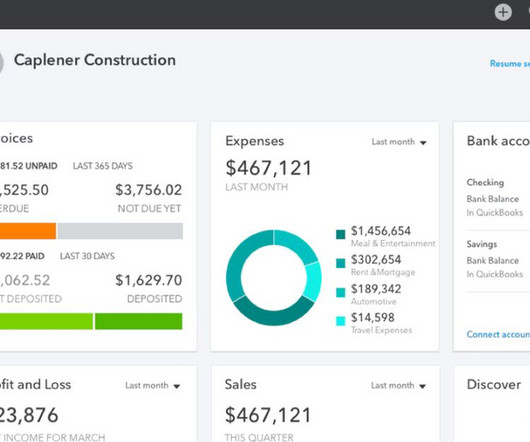

An operating budget is a financial plan that outlines the projected revenues and expenses of an organization or business for a specific period, typically a fiscal year. It serves as a detailed guide for managing day-to-day operations, allocating resources, and achieving financial goals.

Let's personalize your content