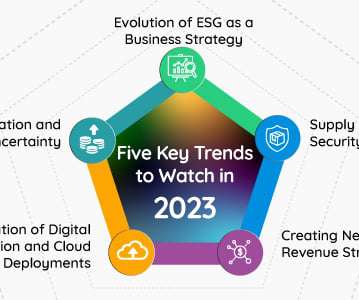

Five Key Trends to Watch in 2023

Bramasol

DECEMBER 20, 2022

Global Inflation and Economic Uncertainty. The McKinsey Global Economics Intelligence report says "Global forecasting institutions, such as the International Monetary Fund, the World Bank, and the OECD, as well as central banks, are trimming growth estimates to align with high inflation and slowing economic activity.".

Let's personalize your content