Data Update 4 for 2024: Danger and Opportunity - Bringing Risk into the Equation!

Musings on Markets

JANUARY 28, 2024

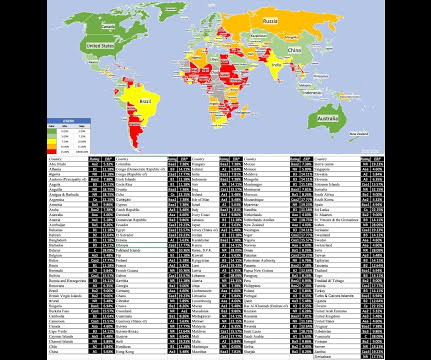

In particular, there are wide variations in how risk is measured, and once measured, across companies and countries, and those variations can lead to differences in expected returns and hurdle rates, central to both corporate finance and investing judgments.

Let's personalize your content