Market Bipolarity: Exuberance versus Exhaustion!

Musings on Markets

OCTOBER 4, 2023

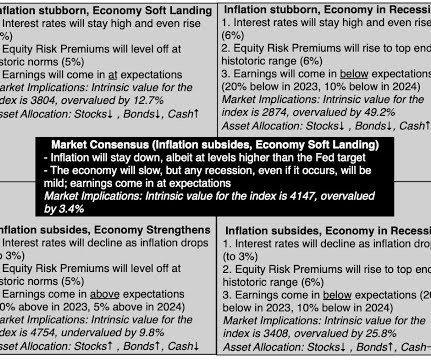

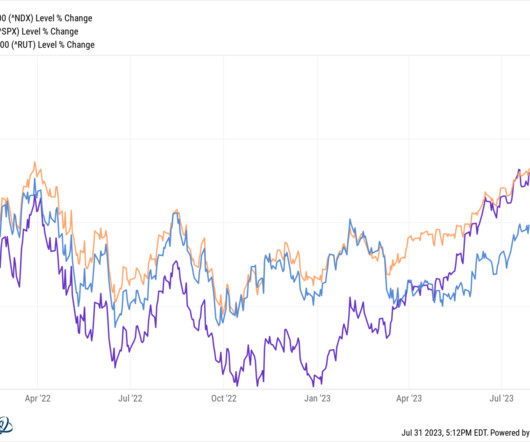

That recovery notwithstanding, uncertainties about inflation and the economy remained unresolved, and those uncertainties became part of the market story in the third quarter of 2023. The Markets in the Third Quarter Coming off a year of rising rates in 2022, interest rates have continued to command center stage in 2023.

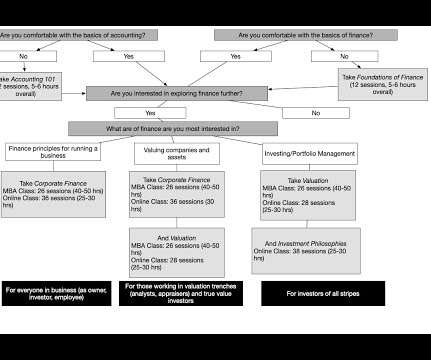

Let's personalize your content