Transcript: Jeffrey Becker, Jennison Associates Chair/CEO

Barry Ritholtz

APRIL 29, 2025

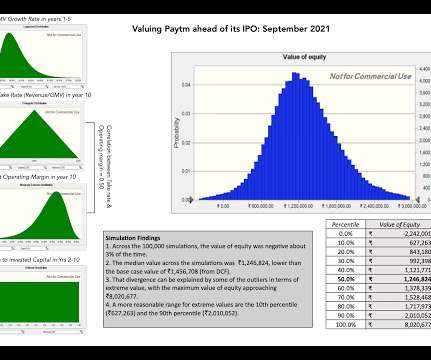

Their focus is on generating alpha with high conviction concentrated portfolios. We learned everything, you know, across from accounting to auditing to, to tax and valuation. I ended up in what was called the valuation services group, where we valued real estate and businesses either for transactions or for m and a activity.

Let's personalize your content