Financial Planning for Efficient Financial Management

Spreadym

NOVEMBER 3, 2023

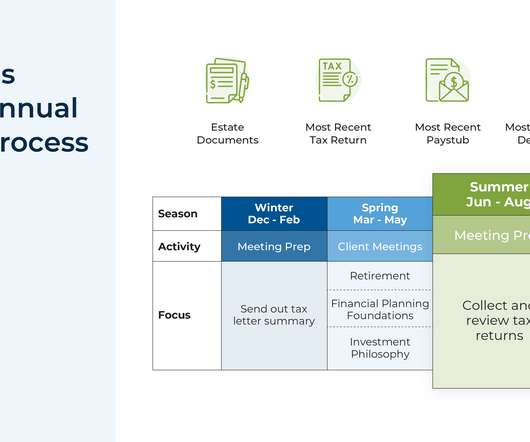

Saving and Investing: Develop a savings plan and investment strategy to build wealth over time. 401(k), IRA), investing in stocks, bonds, real estate, or other assets, and establishing an emergency fund. Tax Planning: Optimize your tax strategy to minimize your tax liabilities and maximize your after-tax income.

Let's personalize your content